2025 CAQH Index® Report

Unlock new tools to explore your data, performance, and potential.

$20.6B

Remained stable

+10%

$75B

$20.6B

Remained stable

+6%

$6.6B

Foreword

Healthcare is personal to all of us. At CAQH, we work to ensure the administrative experience supports care in a clear, connected way for patients and the providers who serve them. Every step matters because it directly shapes the care journey.

For more than a decade, the CAQH Index has given the industry a trusted view of how electronic transactions advance efficiency across medical, dental, and pharmacy services, offering a benchmark for shared learning and a reminder that automation brings real value to people who rely on timely, coordinated care. This year’s findings also reflect a period of recovery and renewed strength, as health plans and providers worked together to restore connections after a cyberattack caused significant disruption to automated systems that reached nearly every part of healthcare. Their collective resilience helped the industry avoid an estimated 258 billion dollars in administrative costs, showing what is possible when collaboration leads the way.

The 2025 Index reflects the contributions of more than 600 provider organizations across medical and dental settings, and health plans representing 63 percent of insured lives. We are grateful for their participation and for the support of America’s Health Insurance Plans (AHIP), American Dental Association (ADA), American Hospital Association (AHA), American Medical Association (AMA), Health Level Seven International (HL7), National Automated Clearing House Association (Nacha), National Council for Prescription Drug Programs (NCPDP), National Dental EDI Council (NDEDIC), and the Workgroup for Electronic Data Interchange (WEDI). Their continued engagement is essential to the accuracy and value of the Index. We also thank the CAQH Index Advisory Council for its ongoing guidance and insight throughout this year’s research process.

We also introduced a refreshed Index format. The Executive Report is available to everyone and provides clear, actionable insights into adoption, spend, and opportunities for improvement. To support organizations that want a deeper level of analysis, we created Index Pro, which includes trended metrics, detailed transaction findings, cost and time savings opportunities, and access to our research team. Subscribers can also explore an interactive site with a return-on-investment calculator and a new Ask the Index feature that makes it easier to get answers and shape strategy.

As technologies evolve, from FHIR-based exchange to AI tools, the Index provides a clear view of how innovation influences the administrative experience. With a shared commitment to efficient systems, we can help ensure that patients and providers feel the benefit.

On behalf of CAQH, I invite you to explore this year’s findings and join us in advancing a healthcare system that feels more connected and intuitive for all.

Overview

For more than 20 years, the healthcare industry has worked to simplify and automate administrative processes, reducing burden, improving efficiency, and keeping care delivery at the center. While challenges such as rising costs, cyber threats, and complex regulations continue to test progress,1,2 the industry has steadily advanced toward a more connected, data-driven system.

That progress faced a new test in 2024. In February, Change Healthcare experienced a major ransomware attack that affected approximately 193 million individuals, making it the largest healthcare data breach in U.S. history.3,4 When the Change Healthcare cyberattack5,6 disrupted clearinghouse and automated payment systems across the country, the industry didn’t stall, it adapted. Payers and providers quickly rerouted transactions and adjusted workflows, relying, in some cases, more on portals and manual processes while restoring automated connections.7,8,9 During outages, staff manually submitted claims10 and exchanged supporting documents for prior authorizations, appeals, or payment requests11, adding strain to workflows that were already largely manual. The industry shifted transaction traffic to other clearinghouses, and once electronic exchanges were reinstated, health plans often managed payment backlogs through bundled or advance payments and phased processing.12,13,14

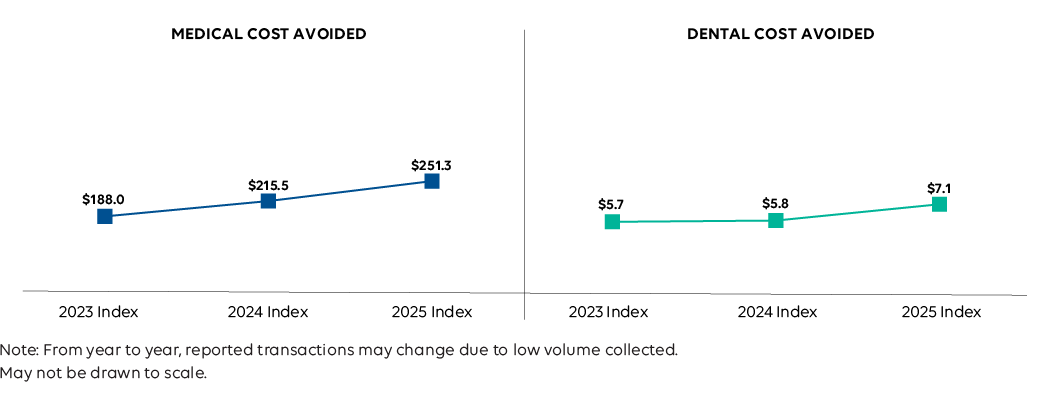

By year-end, the data told a story of recovery and momentum. As systems were re-established or newly connected, electronic administrative workflows were restored and manual processes declined or held steady. Despite the disruption, the industry avoided $258 billion in administrative costs, a 17 percent increase from the previous year, driven by lower electronic costs, expanded automation, and fewer manual transactions. Looking ahead, an additional $21 billion in potential savings remains within reach through further automation.

Interoperability is no longer the goal - it’s the groundwork for what comes next. Adoption of HL7® FHIR-based exchange is accelerating, but progress remains largely compliance-driven: 57 percent of medical plans and all dental plans indicated that their primary motivation for current interoperability developments is to meet Centers for Medicare & Medicaid Services (CMS)15,16 or Office of the National Coordinator for Health Information Technology (ONC)17 guidelines. Most medical plans (63 percent) are still developing their electronic prior authorization (ePA) FHIR APIs ahead of January 2026 requirements, while only 20 percent of providers have begun implementation.* To move from compliance to true interoperability, the industry must align regulatory efforts with vendor readiness, provider engagement, and proof of ROI. This alignment turns automation into action.

* Data represents findings from a FHIR pilot survey and supplemental Index questions. Additional insights will be released as part of Index Pro in Q2 2026.

Key Terms

- Adoption Rate

The degree to which medical and dental plans and providers complete transactions using fully electronic, partially electronic, or manual modes. - Estimated Volume

The number of fully electronic, partially electronic, and manual administrative transactions reported by medical and dental plans and providers weighted to a national level. - Fully Electronic

Administrative transactions conducted using a HIPAA-mandated standard, unless otherwise specified. - Partially Electronic

Administrative transactions conducted using web portals and interactive voice response (IVR) systems. - Fully Manual (Manual)

Administrative transactions requiring end-to-end human interaction such as telephone, mail, fax and email.

Financial Metrics

- Cost Per Transaction

The labor costs (e.g., salaries, wages, personnel benefits and related overhead) associated with full electronic, partially electronic, and fully manual transactions. Costs include the labor time required to conduct the administrative transaction, not the time and cost associated with gathering information for the transaction and follow-up. Costs do not include system costs (e.g., maintaining, building or buying software or other equipment). - Administrative Spend (Estimated Spend)

The amount that medical and dental plans and providers spend conducting an administrative transaction in total and by modality. - Cost Avoided

The amount that medical and dental plans and providers have saved by not conducting administrative transactions using partially electronic or manual modes. - Cost Savings Opportunity

The administrative cost savings that could be achieved by switching the remaining partially electronic and manual transactions to fully electronic transactions. - Time Savings Opportunity

The time that providers could save by switching partially electronic and manual transactions to fully electronic transactions.

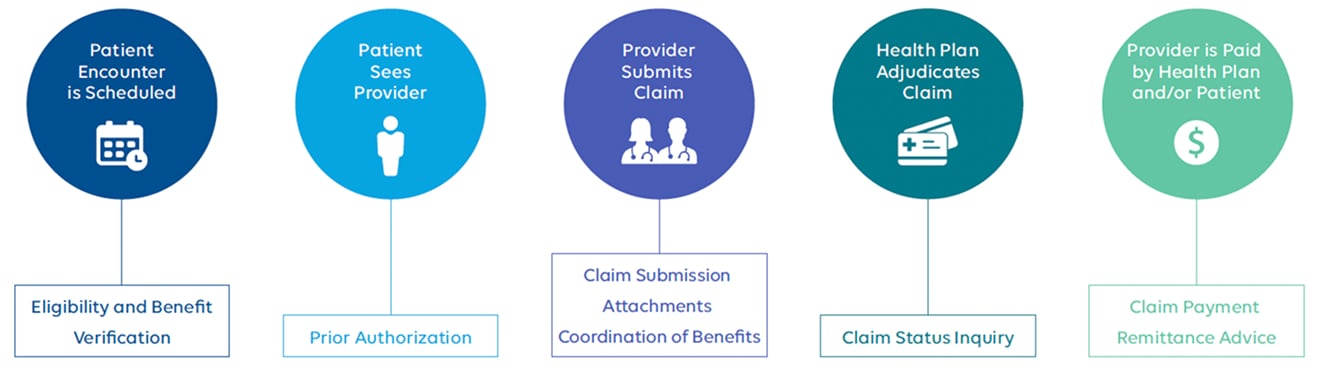

The Administrative Workflow

When patients visit a healthcare provider, their journey involves a series of administrative tasks that start with scheduling the appointment and end with payment for the care they receive. These tasks are essential to ensuring care is delivered, but they can also be time-consuming and costly.

The CAQH Index collects detailed information from both providers and health plans on how these administrative tasks are completed. It tracks the methods used, whether fully electronic, partially electronic, or manually, along with the number of transactions processed (volume) and the cost and time required to complete.

By analyzing this data, the CAQH Index highlights inefficiencies in the administrative workflow and identifies opportunities to reduce the time and cost involved. These improvements not only benefit providers by freeing up resources but also ensure patients experience fewer delays in accessing care.

As new technologies automate routine tasks, improve data sharing, and reduce manual work, the CAQH Index is evolving to measure their implementation and impact. By tracking how tools such as AI, FHIR APIs, and ePA are being adopted and used, the Index is becoming a forward-looking benchmark for the modernization of healthcare administration.

Acknowledgements*

* The reporting of Acknowledgements has been retired after achieving consistent 100% electronic adoption. Data is included in total volume for trend analyses.

Note: This diagram illustrates the administrative workflow in its simplest form. In practice, some transactions may occur multiple times or in multiple steps and be triggered by other events.

Key Findings

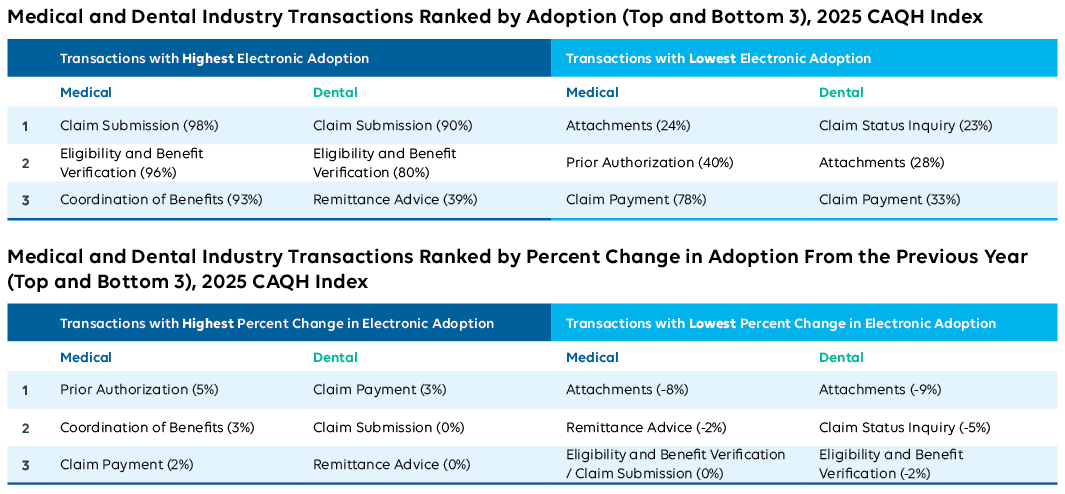

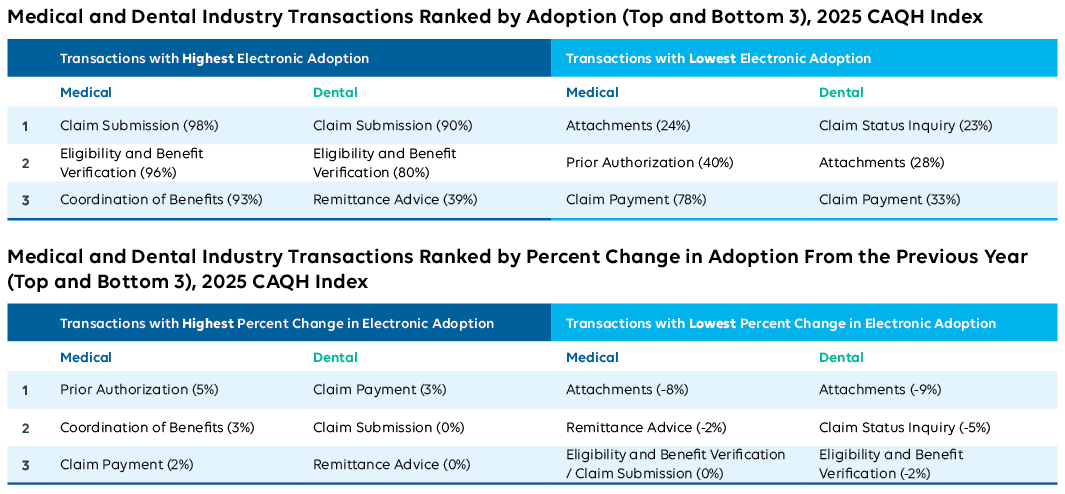

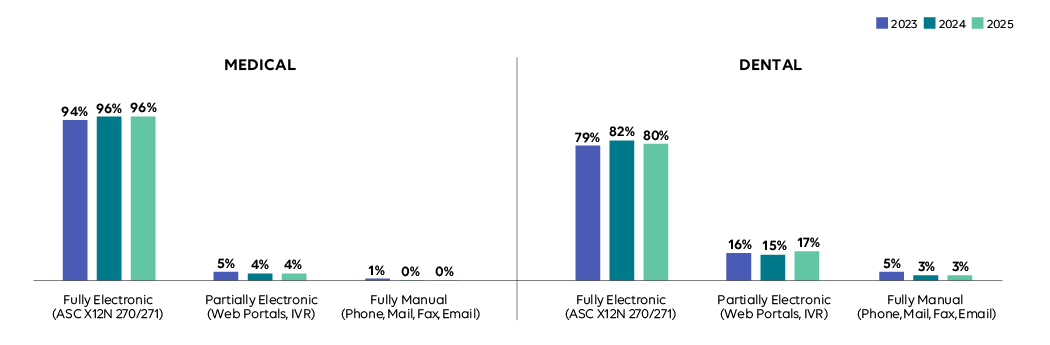

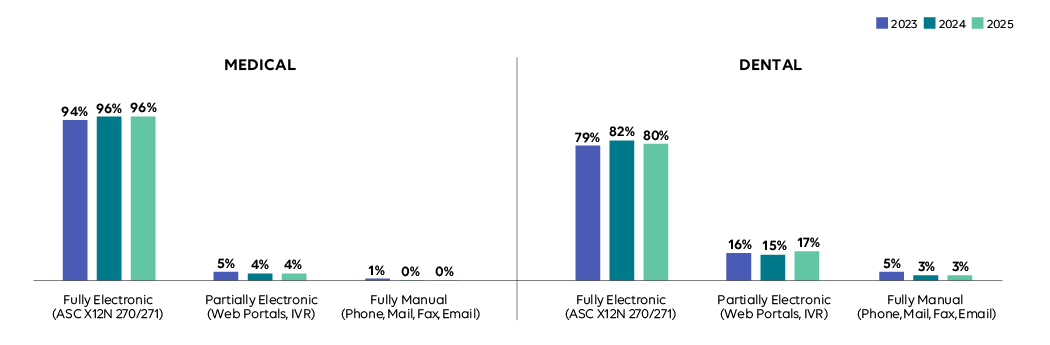

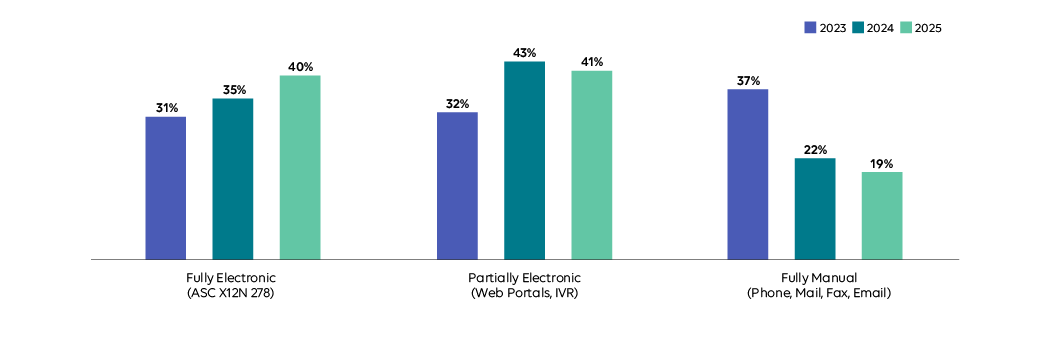

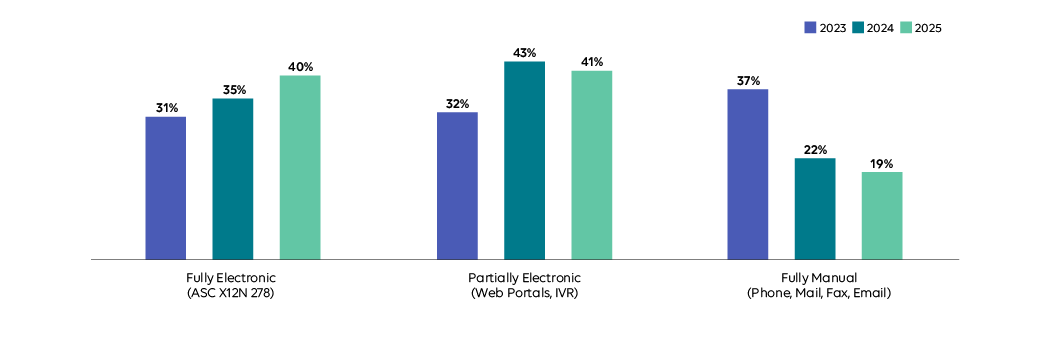

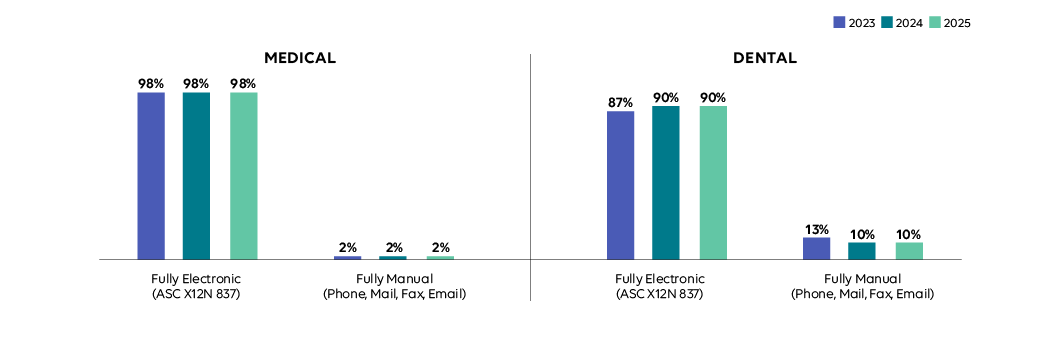

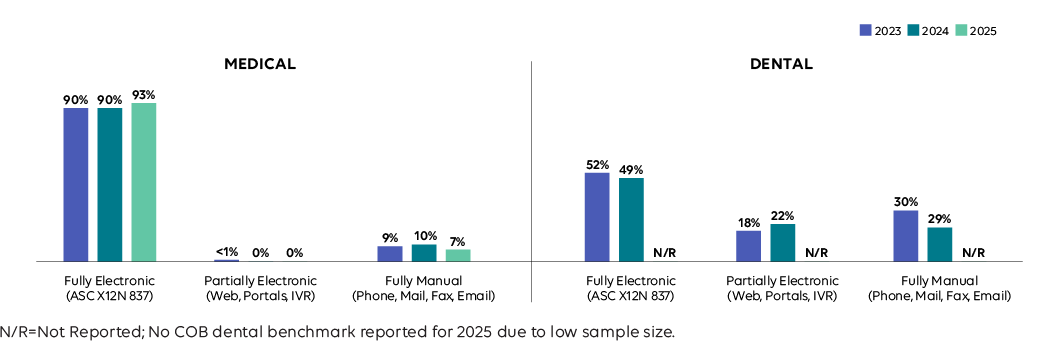

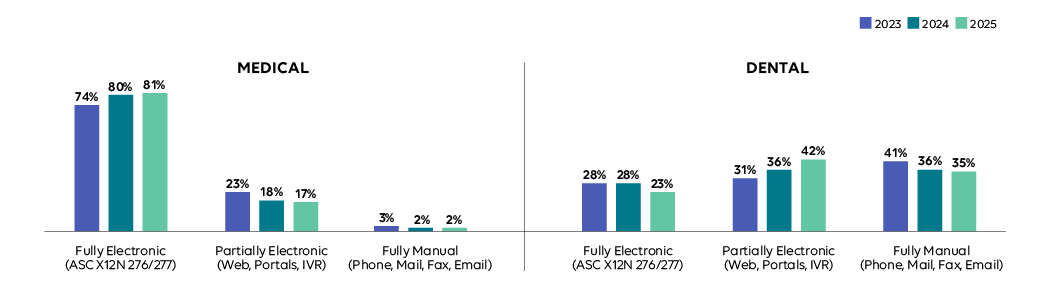

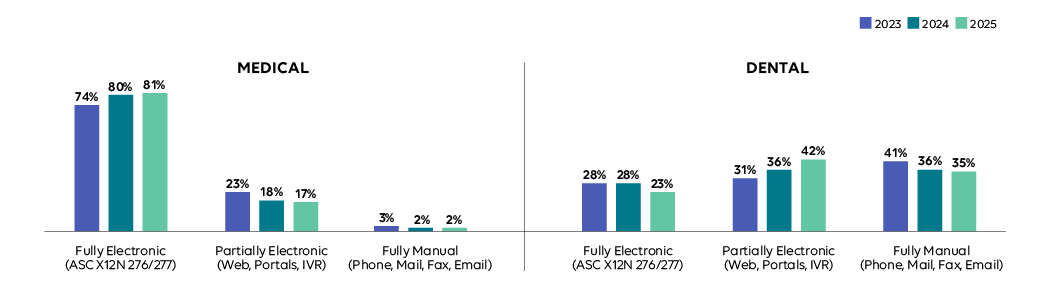

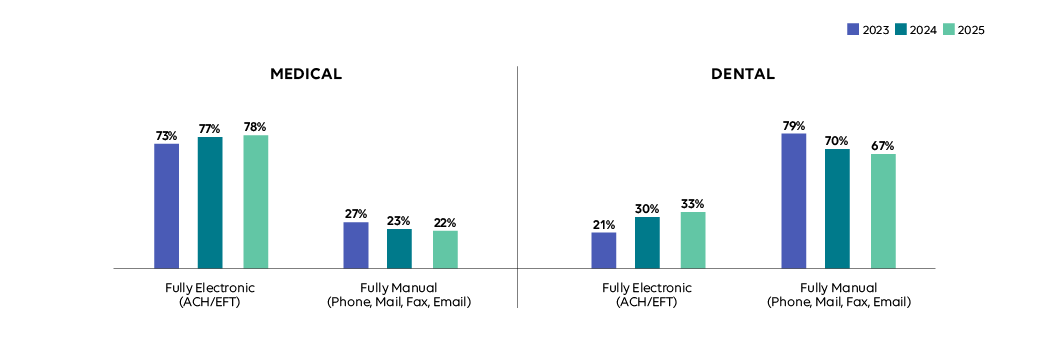

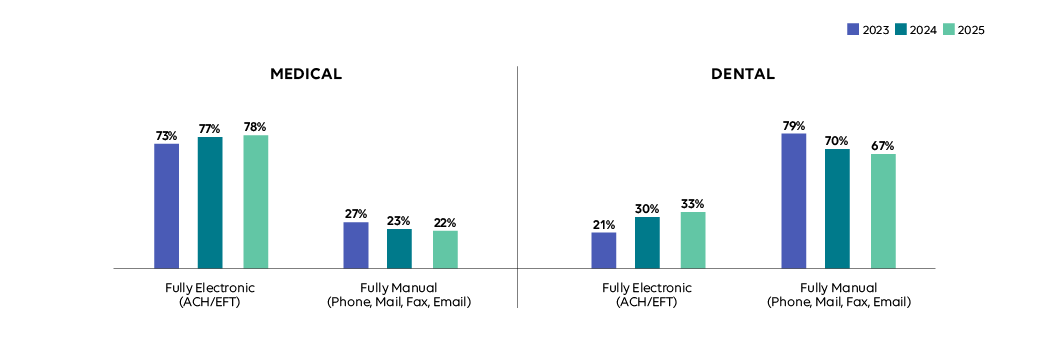

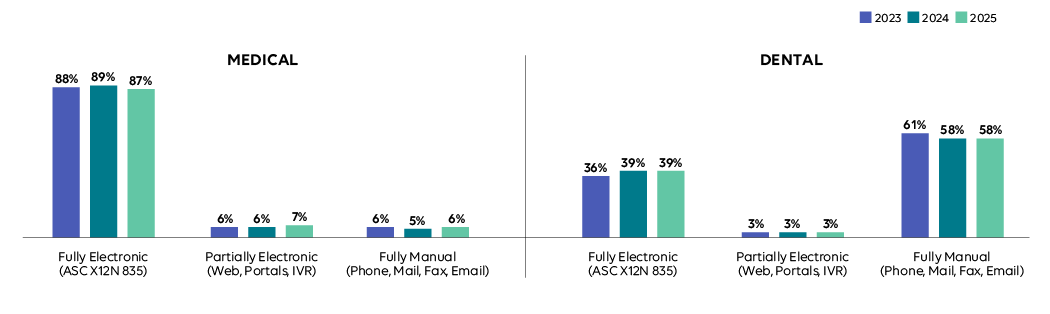

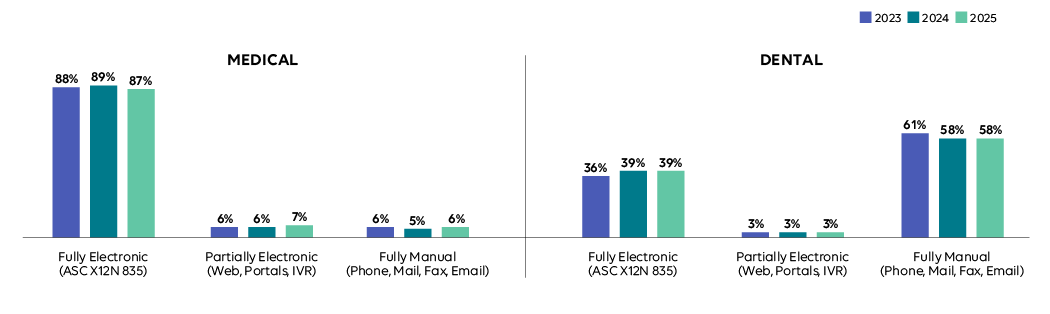

Adoption

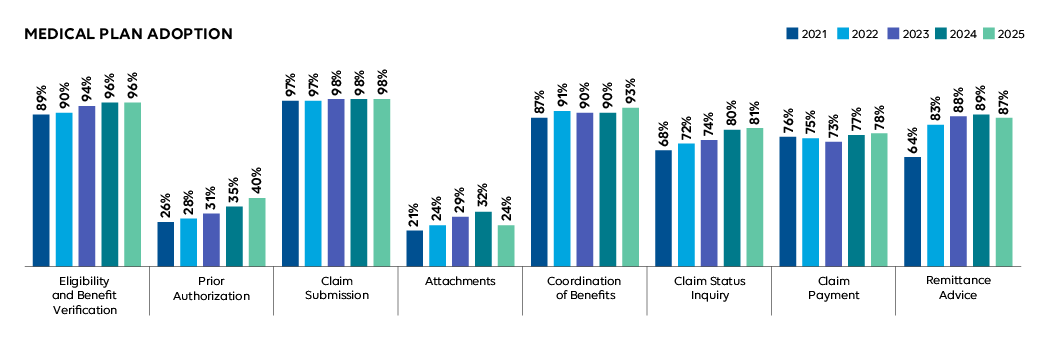

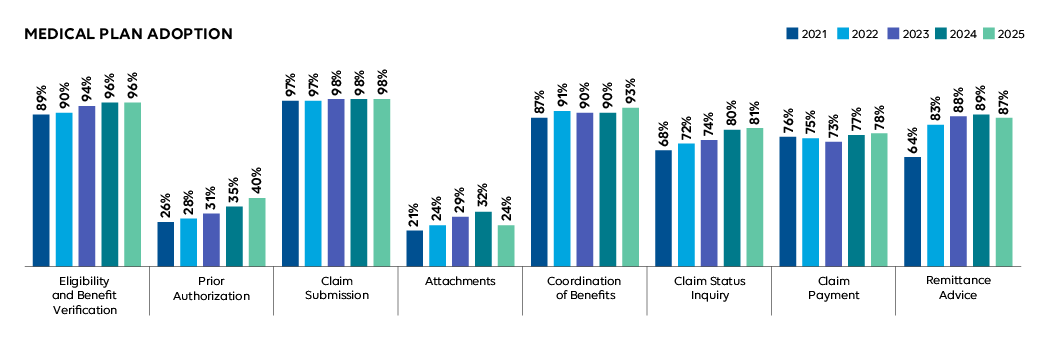

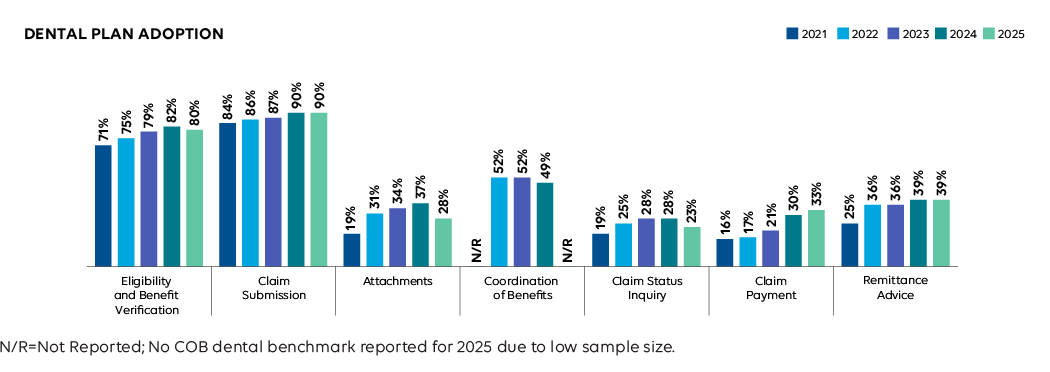

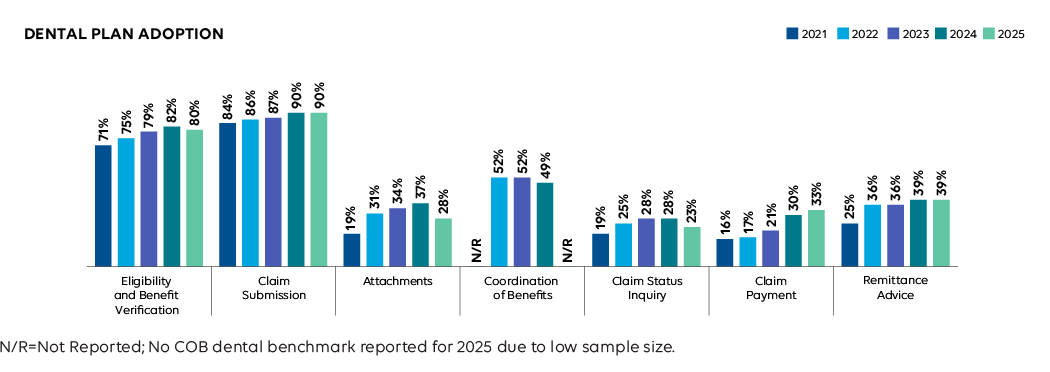

Medical electronic adoption improved or remained stable for all transactions, except for Attachments and Remittance Advice. Dental adoption slowed or fell across all transactions except Claim Payment. As organizations worked to recover from the Change Healthcare cyberattack, many prioritized system stability over new automation efforts, temporarily slowing progress but underscoring the resilience of existing electronic infrastructure.

Remained stable

Following a gain the previous year, average adoption across both industries held steady.

Industry Impact: Stable electronic adoption protected providers and patients from deeper disruption during the cyberattack, limiting payment delays and care interruptions. But the slowdown in new automation signals risk. Without continued progress, providers remain exposed to manual work during crises, and patients face billing confusion. The industry’s next challenge is strengthening resilience while continuing to reduce administrative burden.

Medical Plan Adoption of Fully Electronic Administrative Transactions, 2023-2025 CAQH Index

Dental Plan Adoption of Fully Electronic Administrative Transactions, 2023-2025 CAQH Index

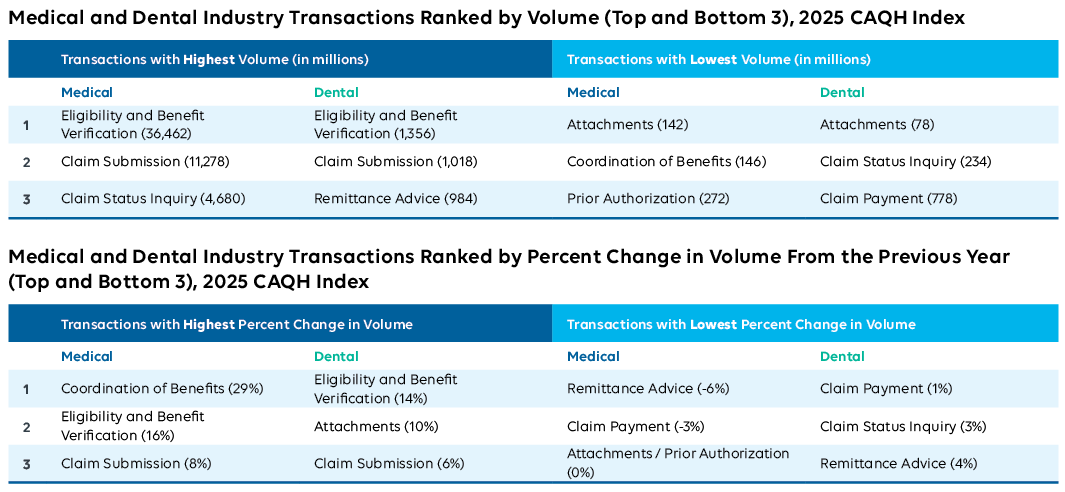

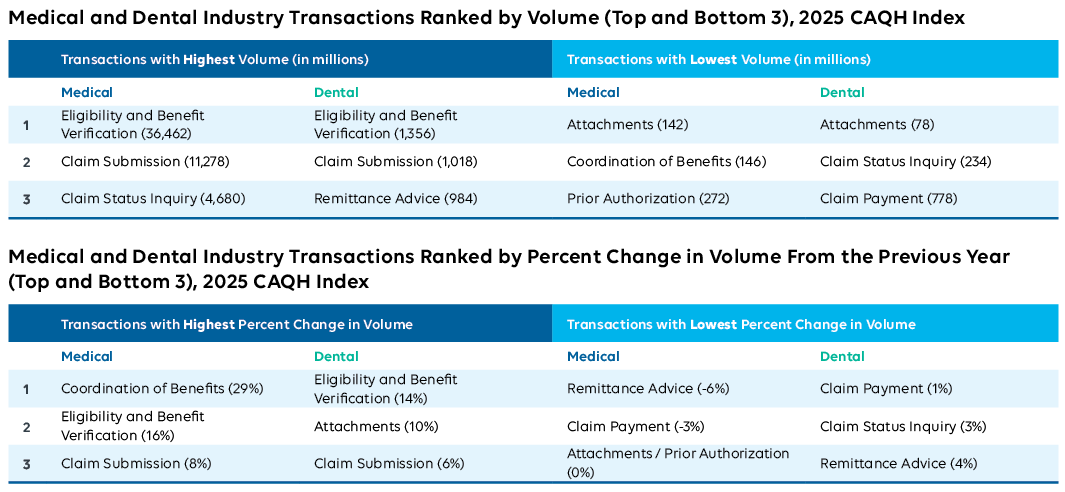

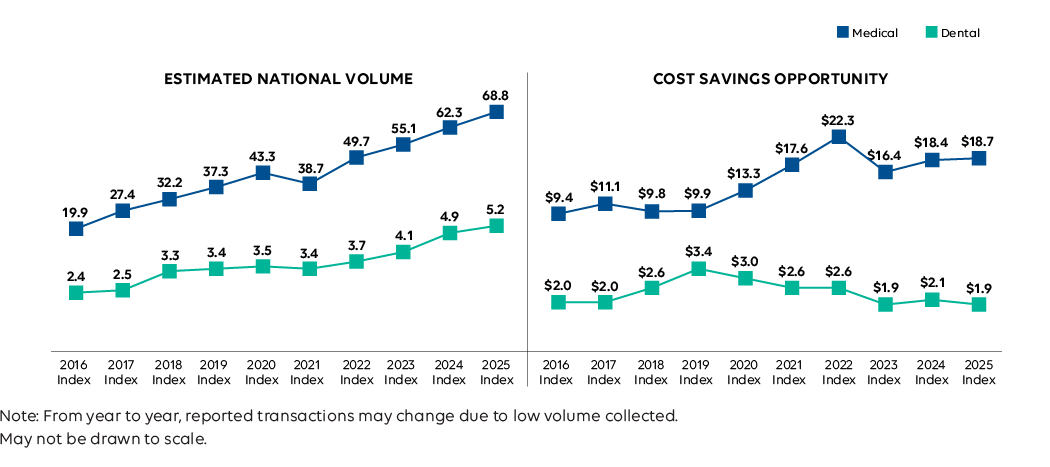

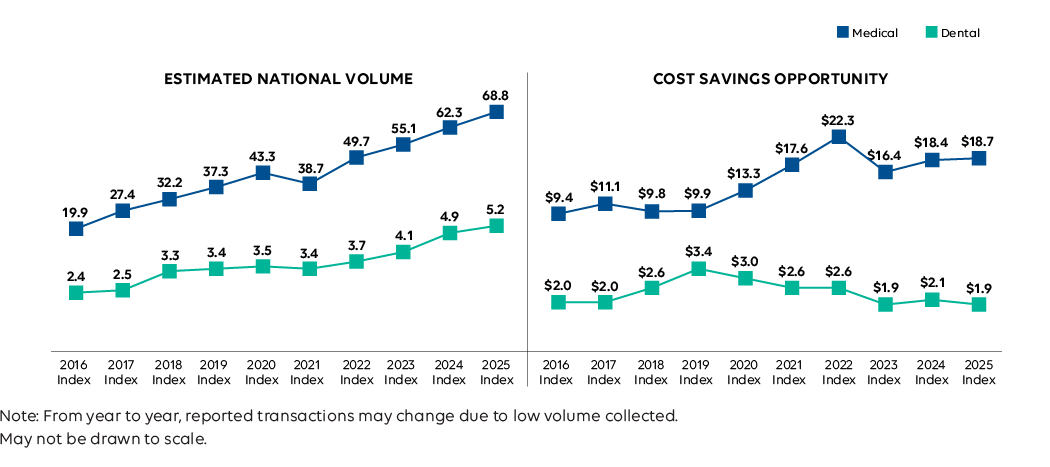

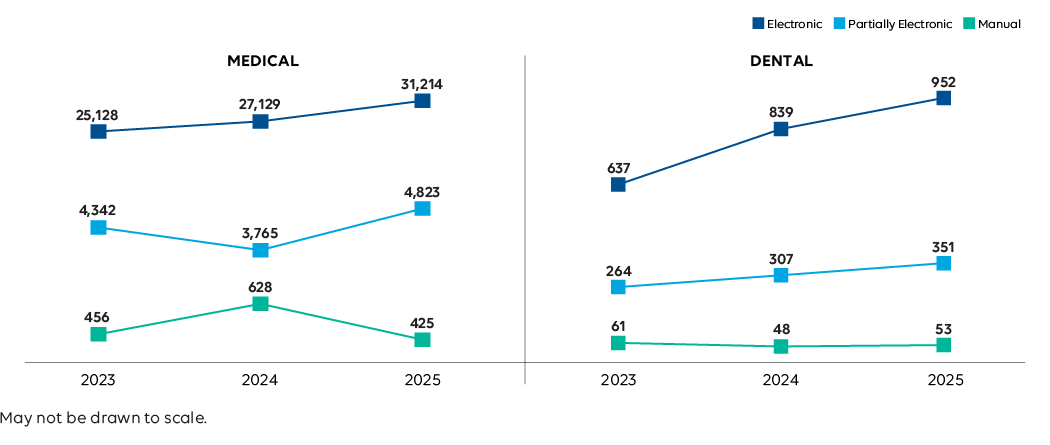

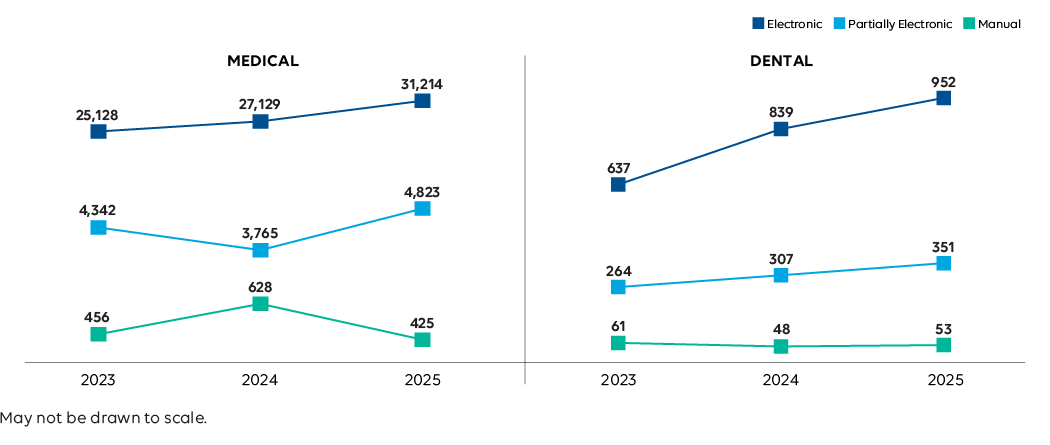

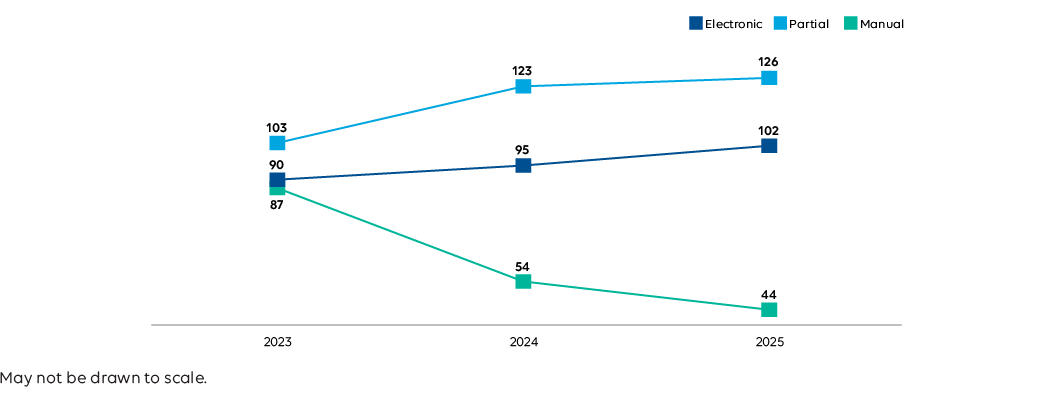

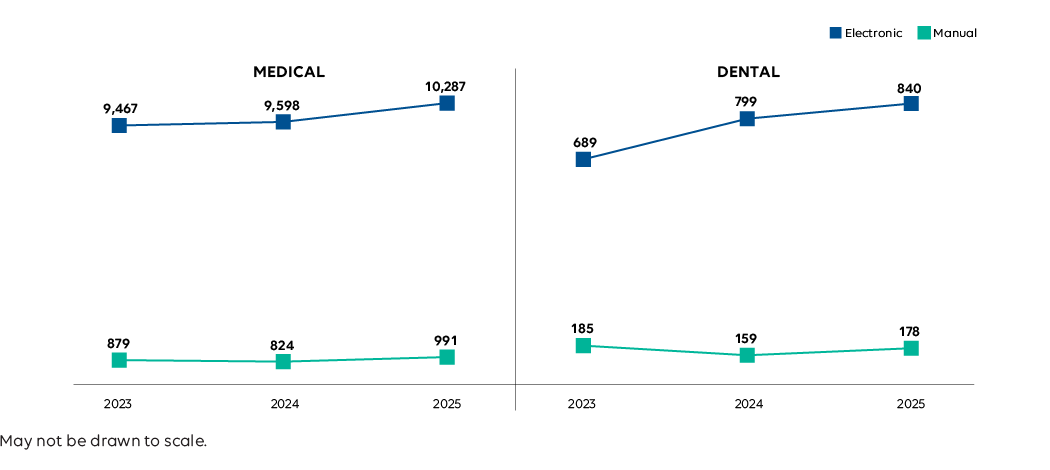

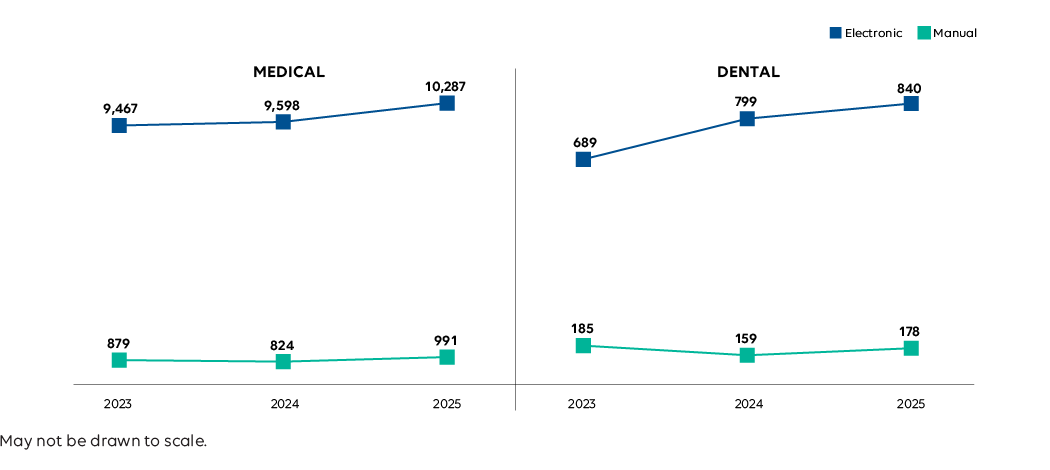

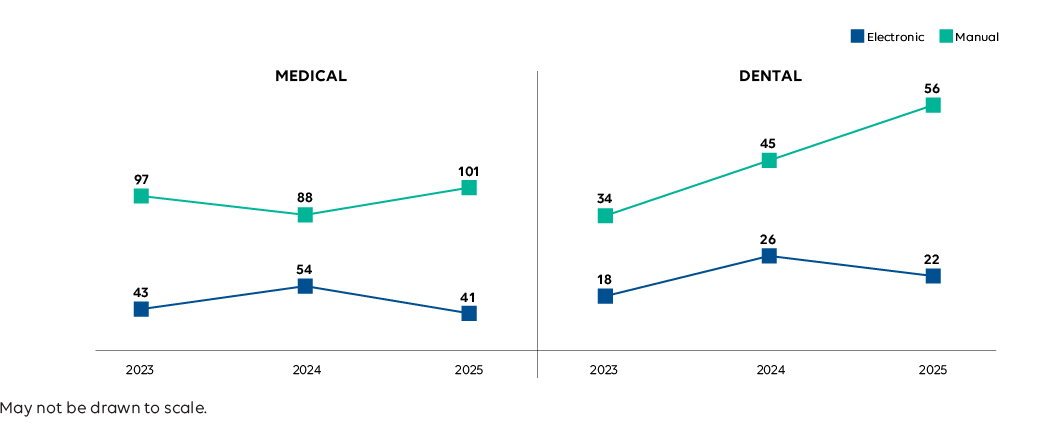

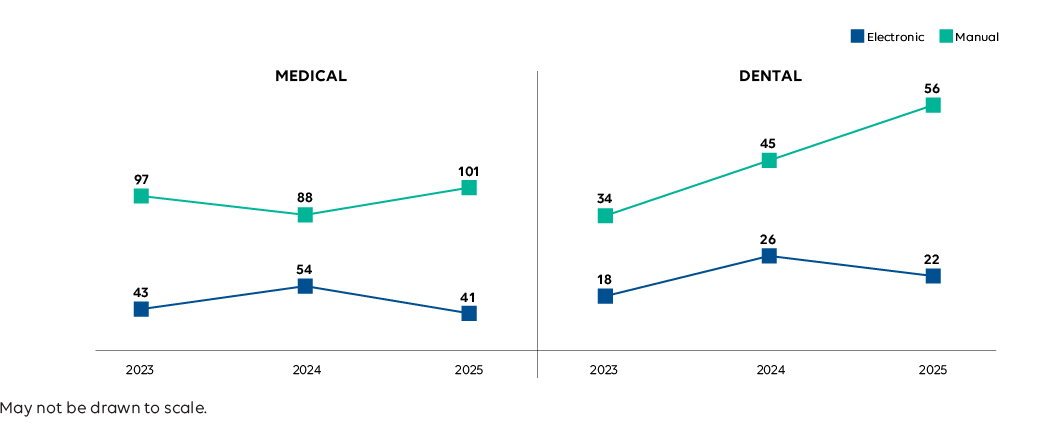

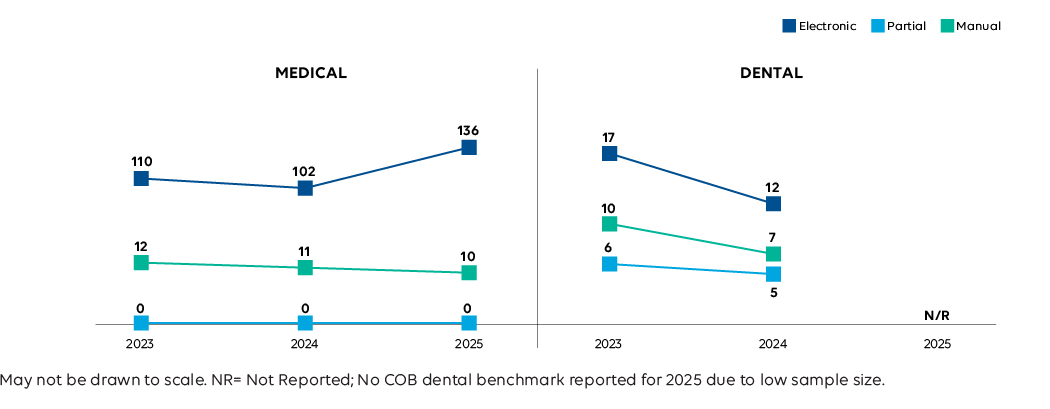

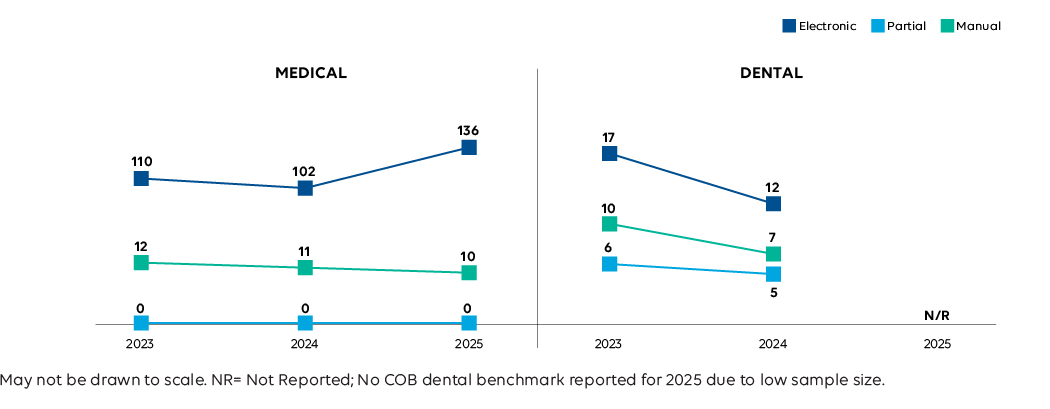

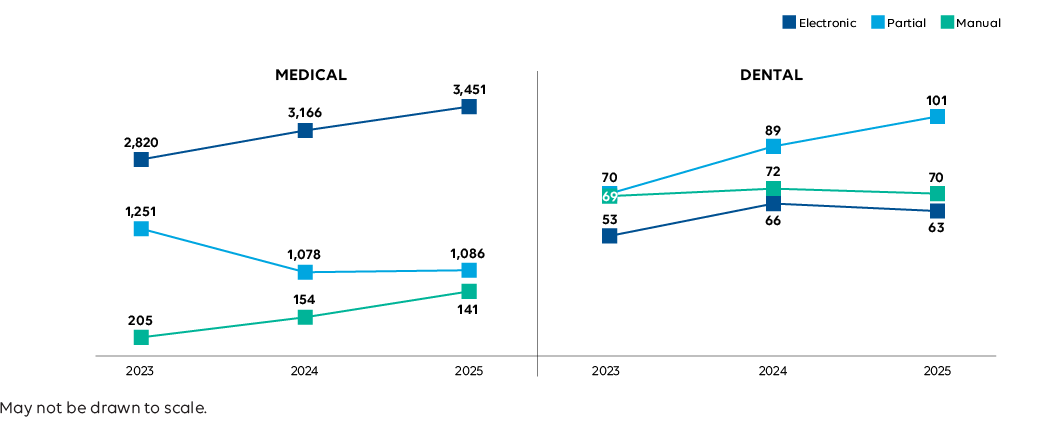

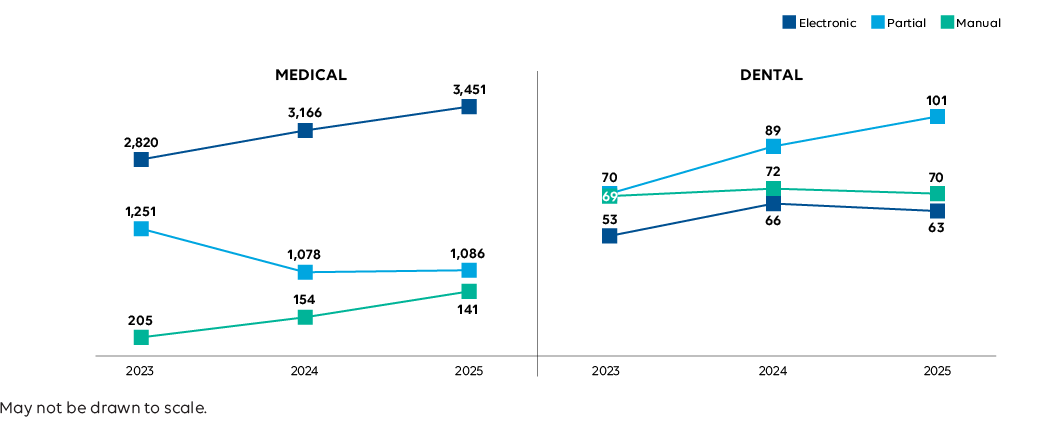

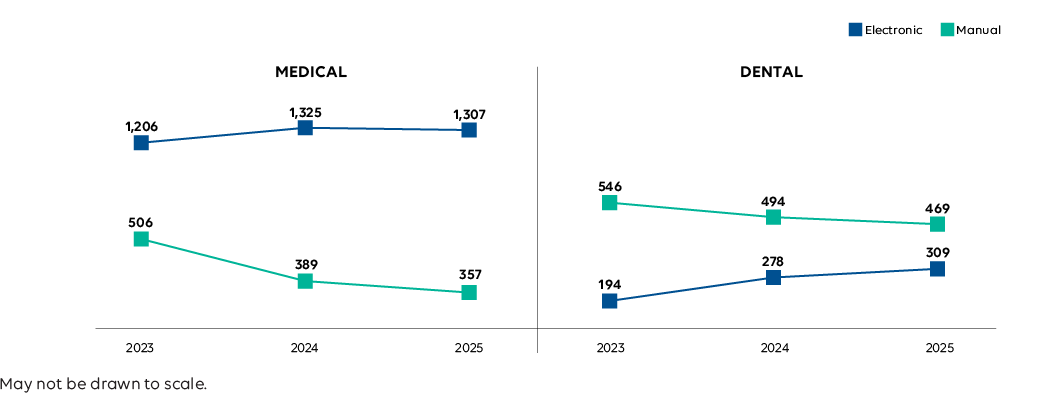

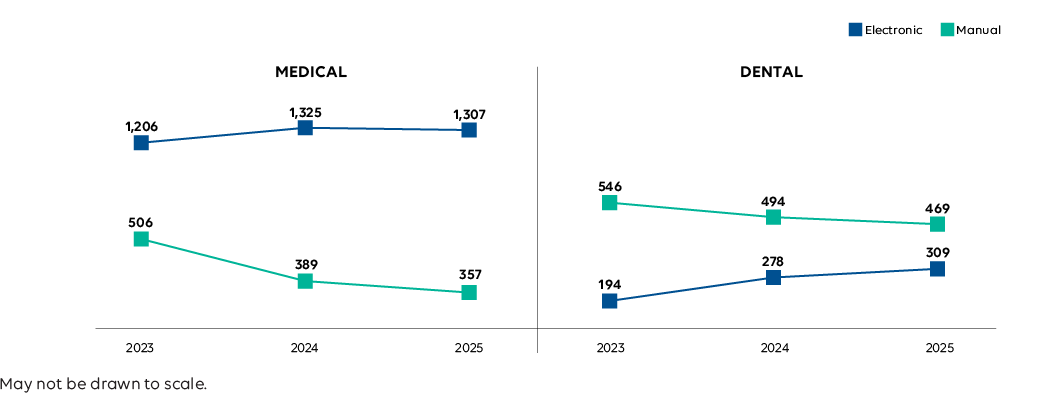

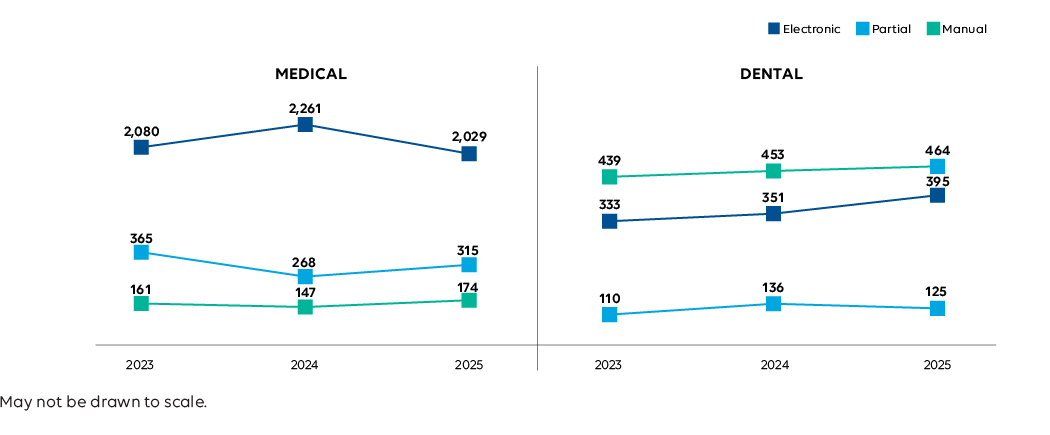

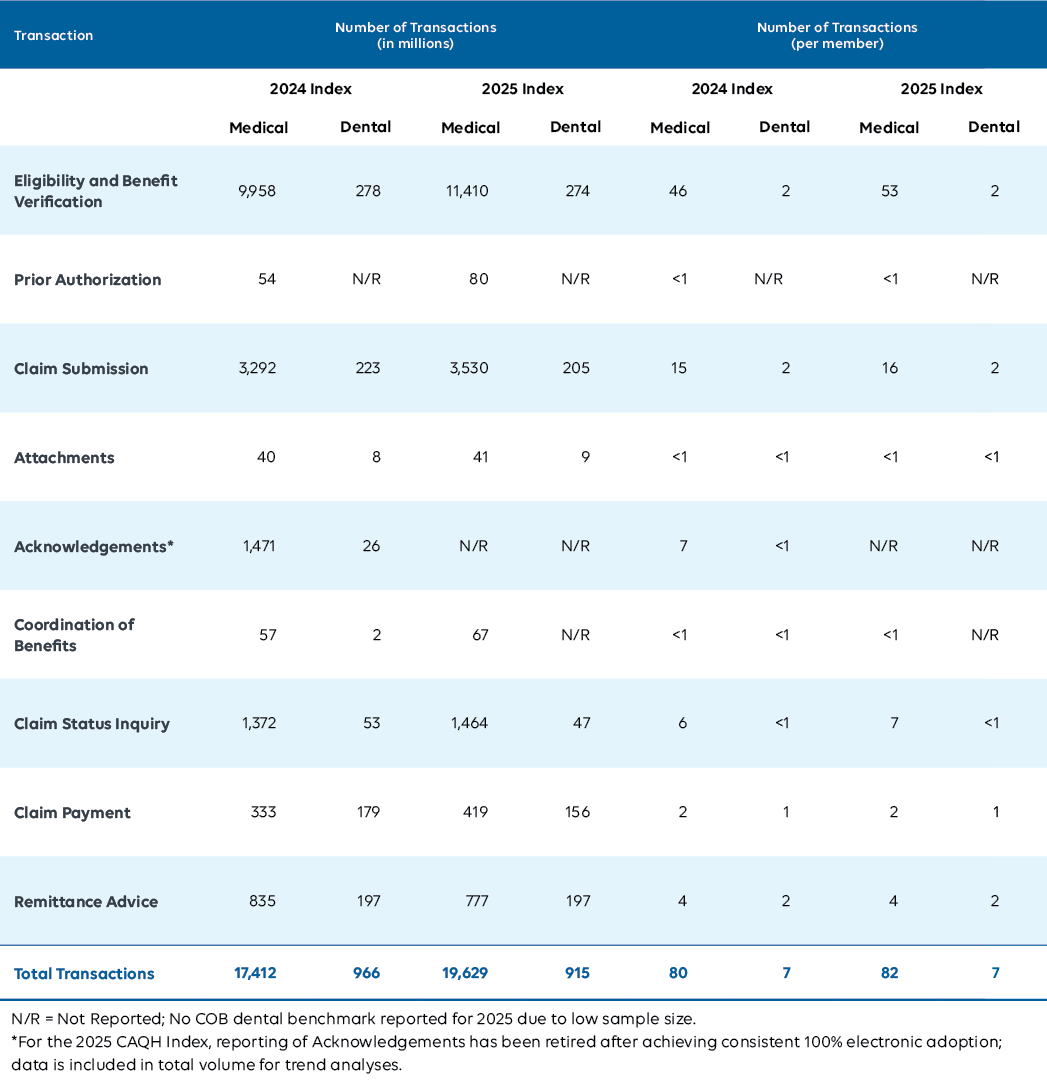

Volume

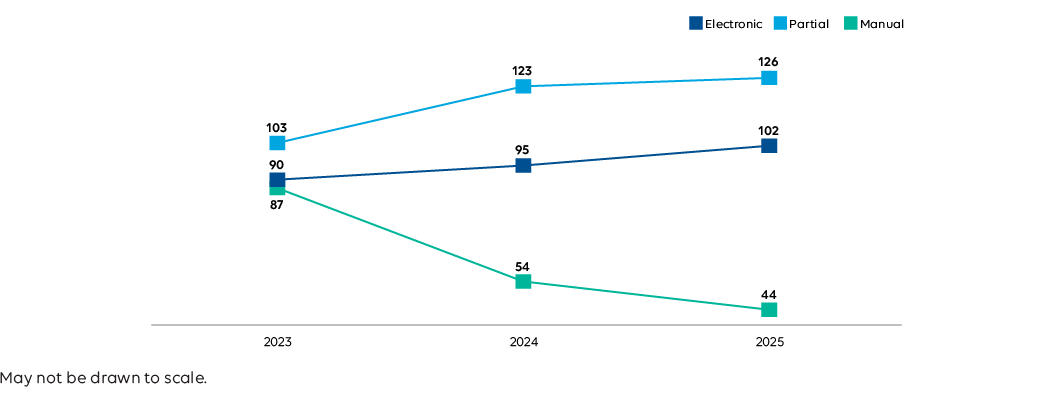

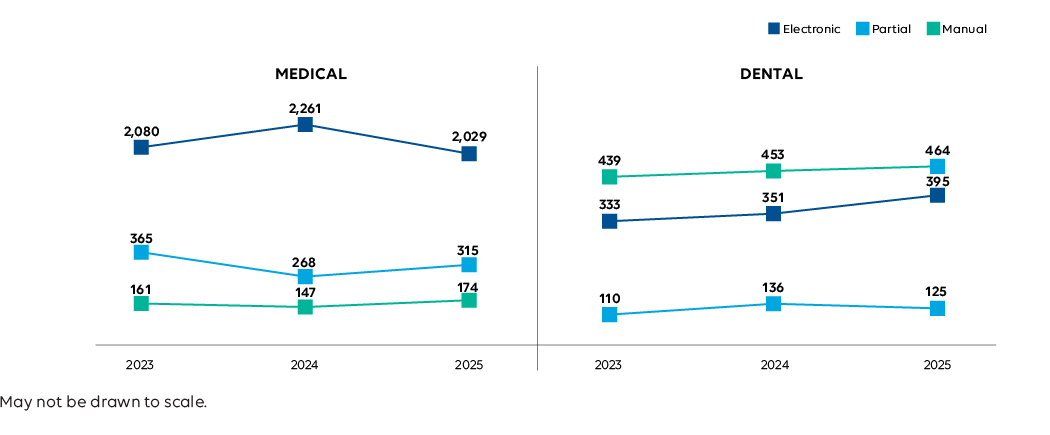

Growth remained positive but moderate compared to prior years, reflecting the operational challenges and recovery efforts that followed the cyberattack. In some cases, organizations relied on temporary manual or hybrid processes while restoring automated connections.

+10%

overall increase in medical transaction volume.

+6%

overall increase in dental transaction volume.

Industry Impact: Moderate transaction growth signals that providers kept care and payments moving, even while relying on manual workarounds. Those stopgap processes come at a cost. They increase administrative burden, slow reimbursement, and raise the risk of errors that ultimately affect patients. Sustained volume growth depends on restoring and modernizing automation so the system can scale without sacrificing access, accuracy, or trust.

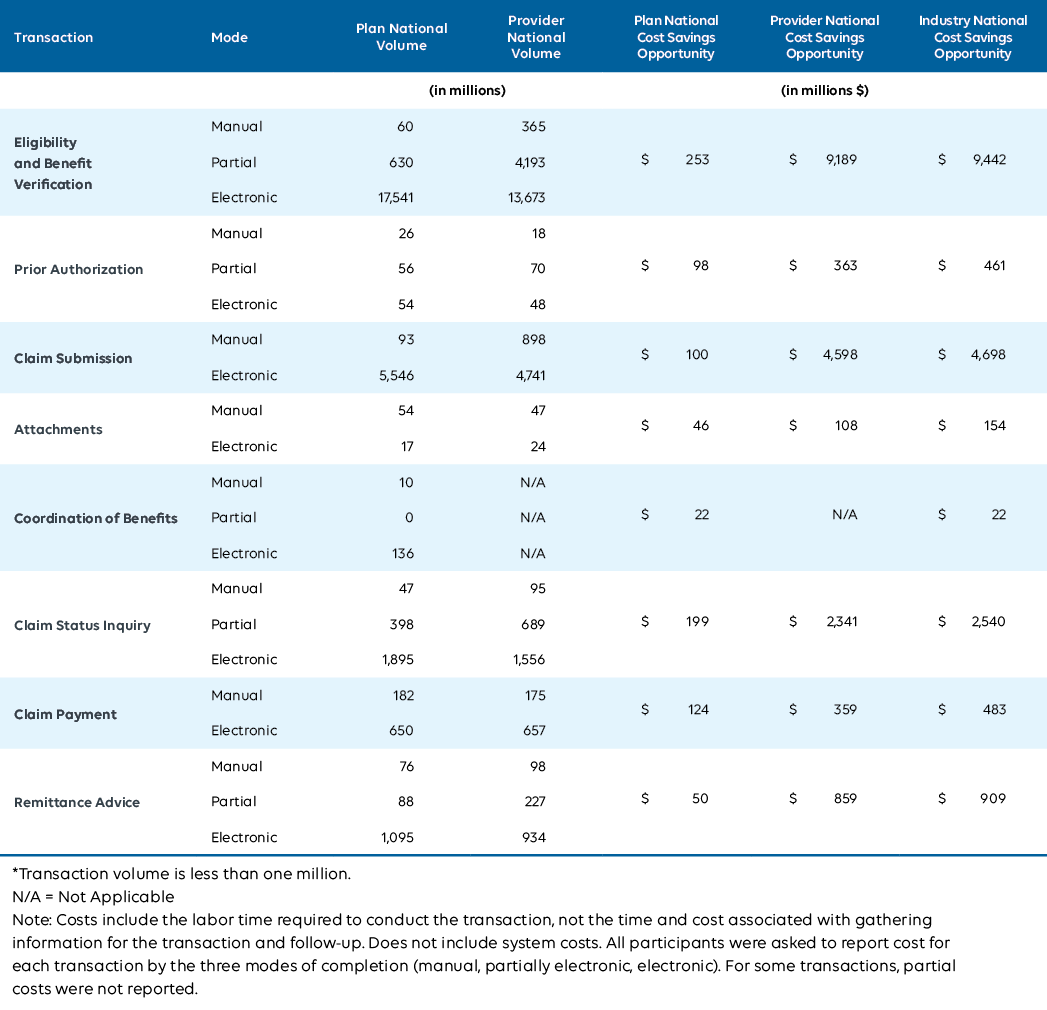

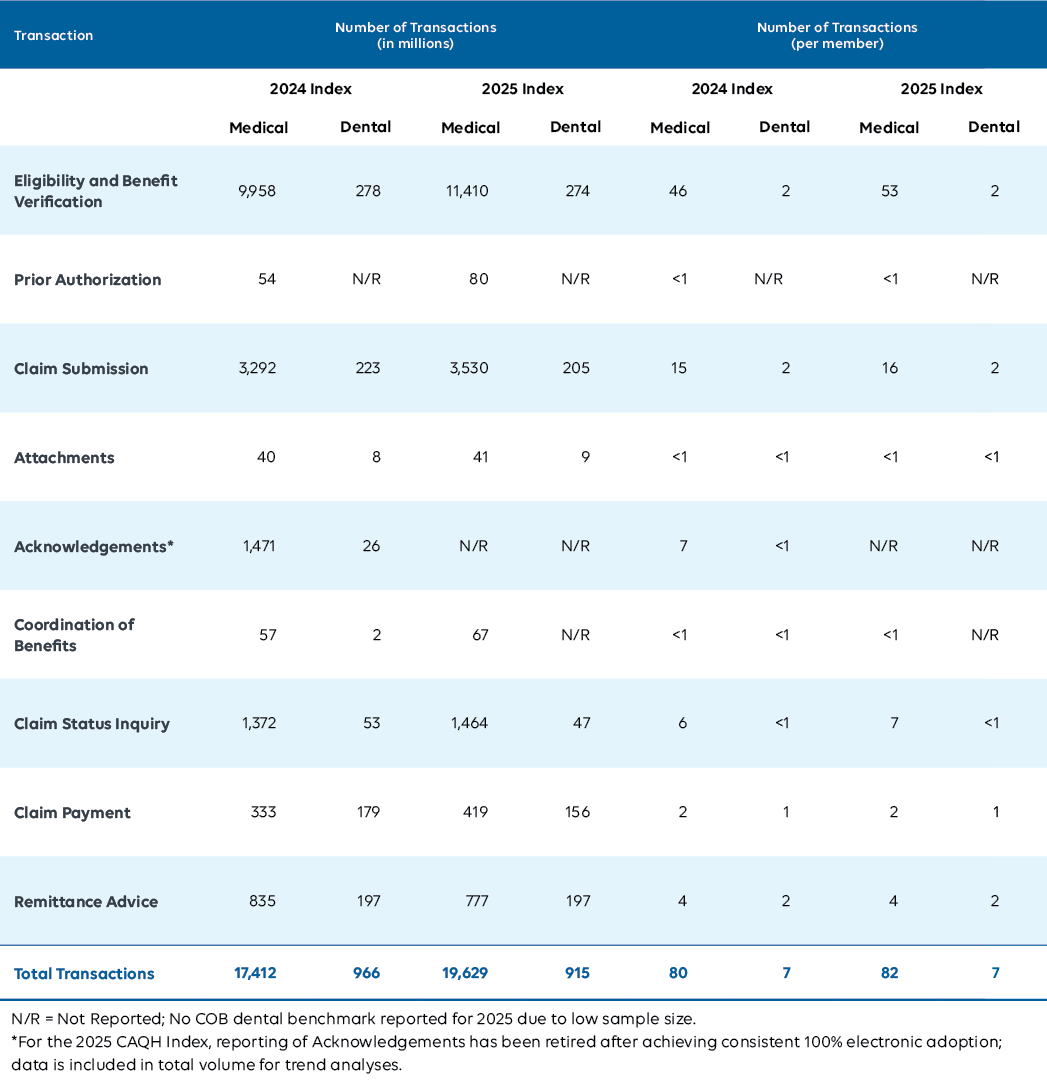

Medical and Dental Industry Estimated National Volume

2023-2025 CAQH Index (in billions)

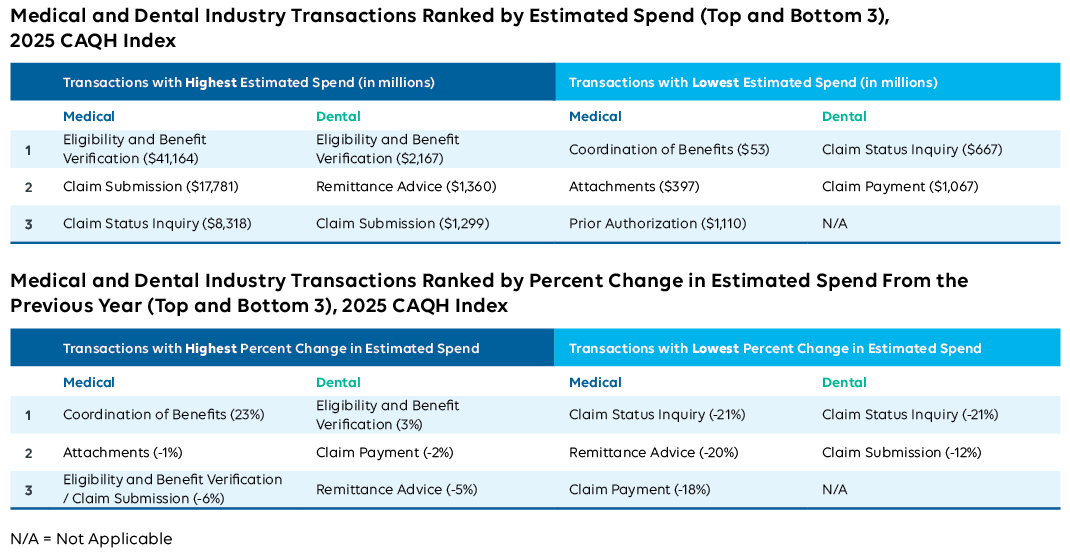

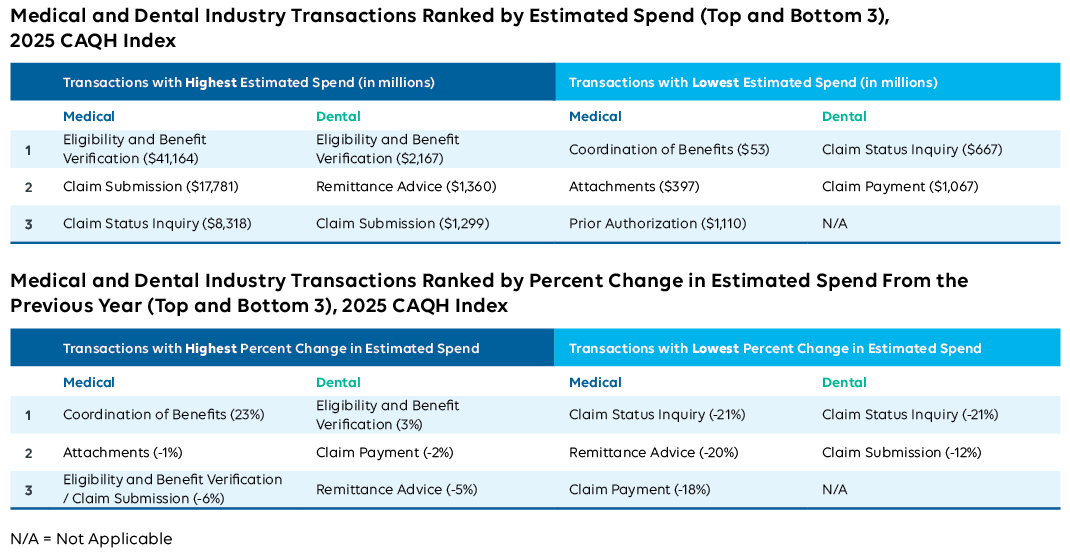

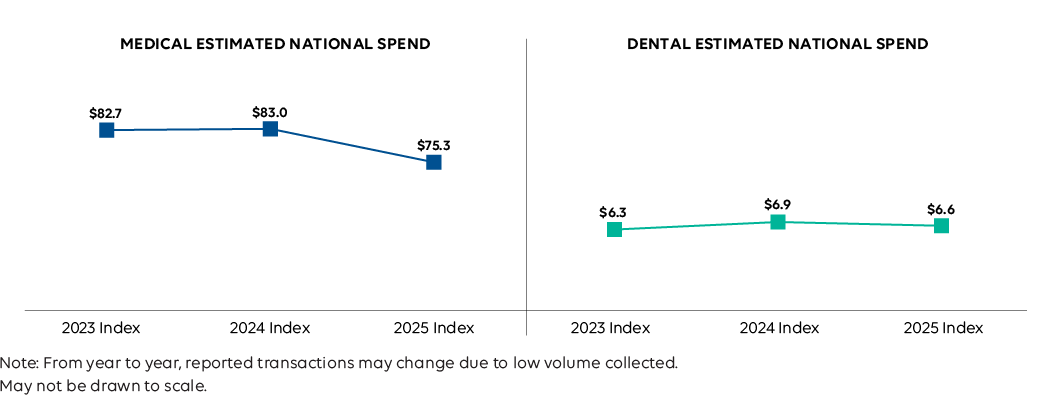

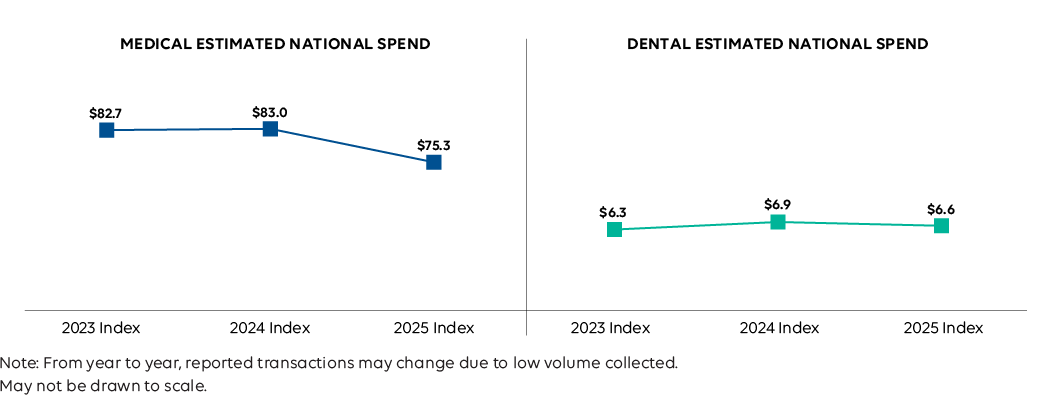

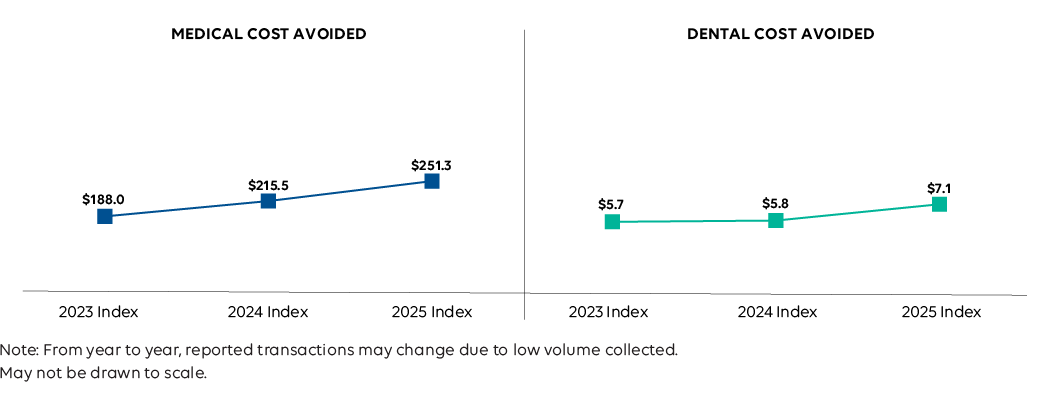

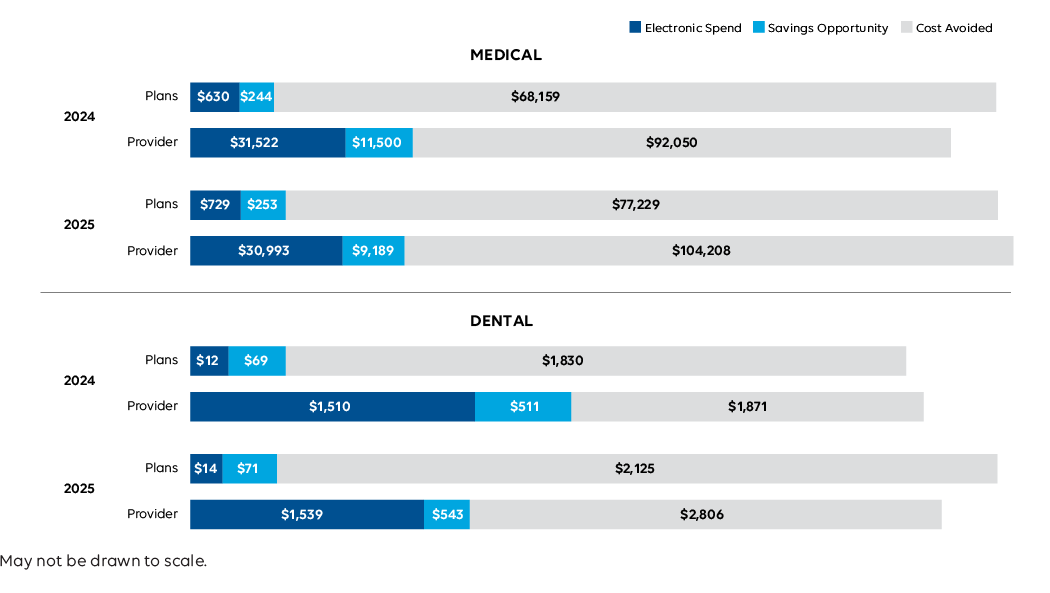

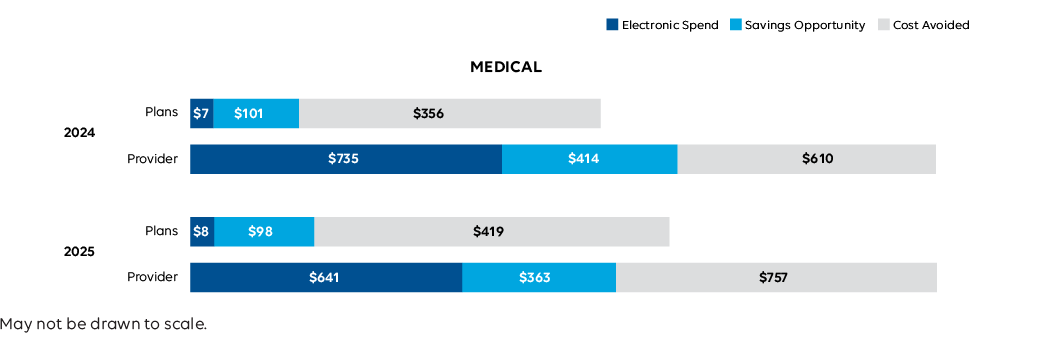

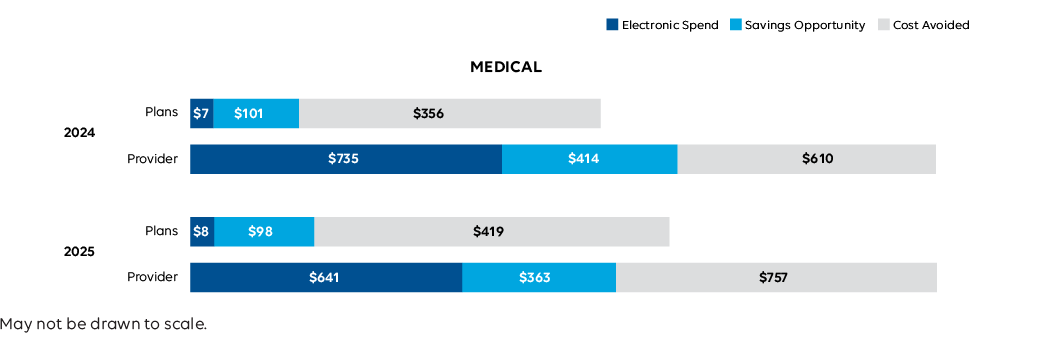

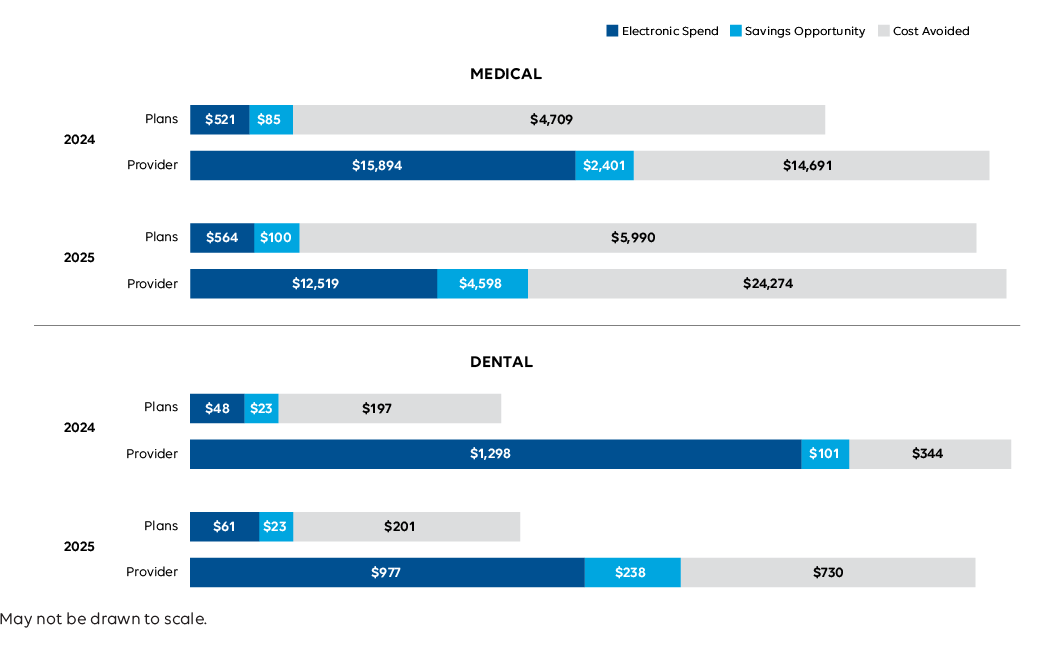

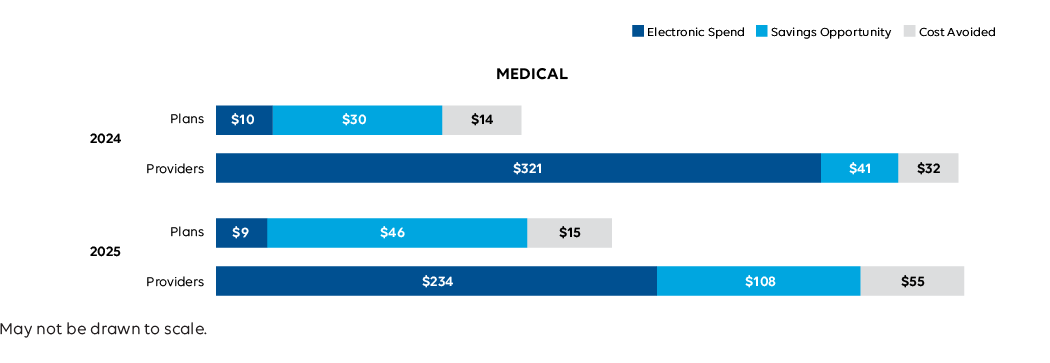

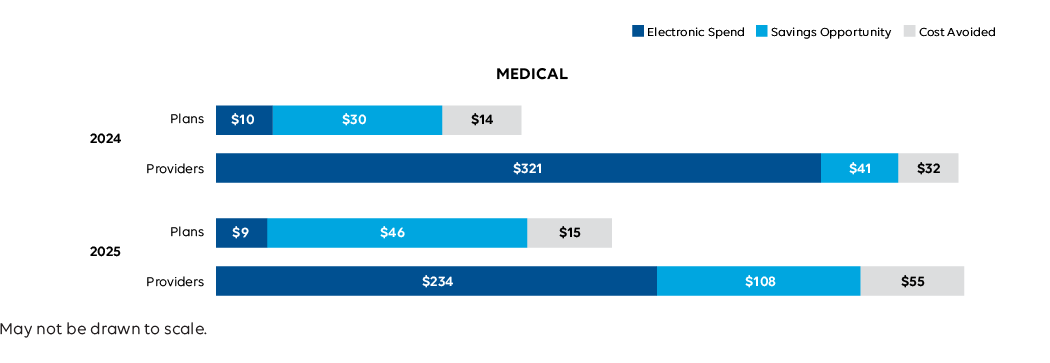

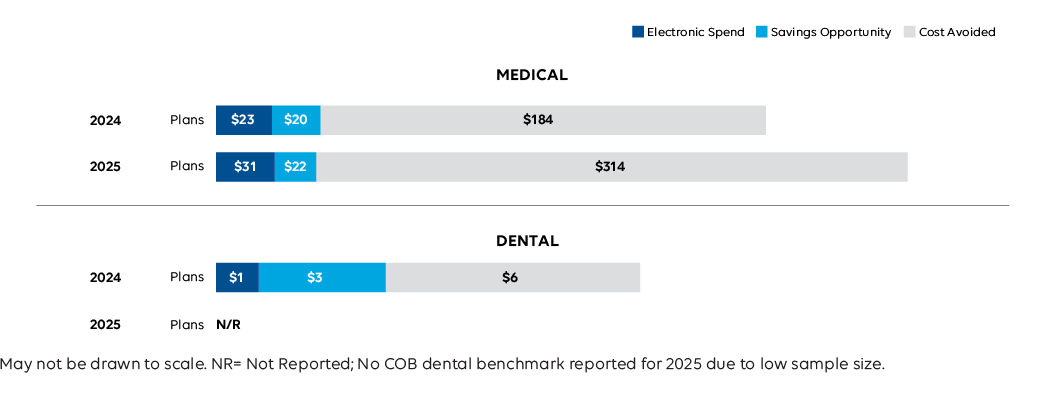

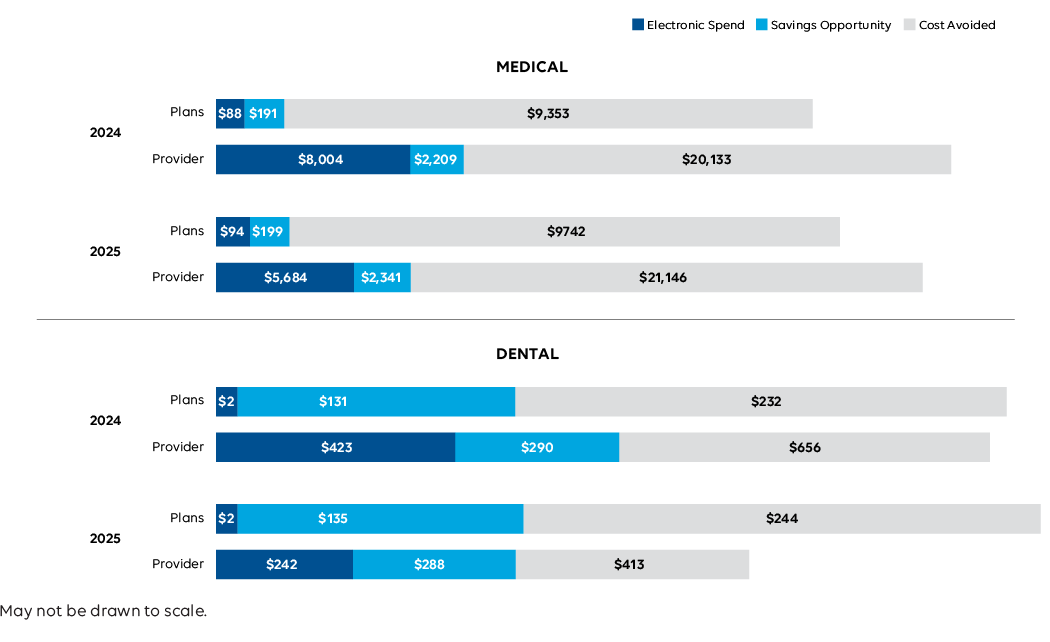

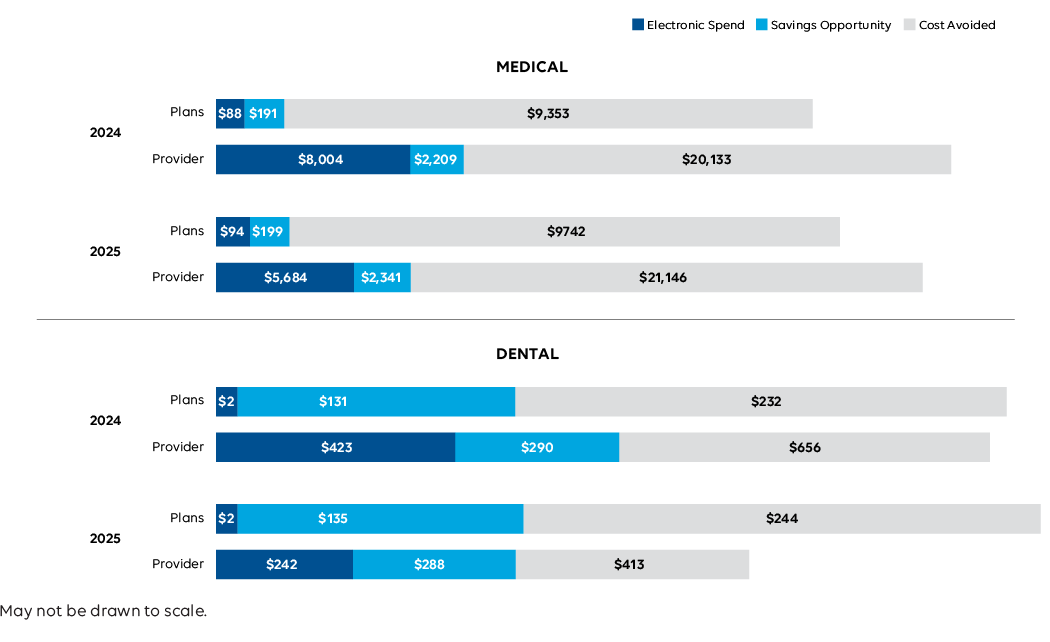

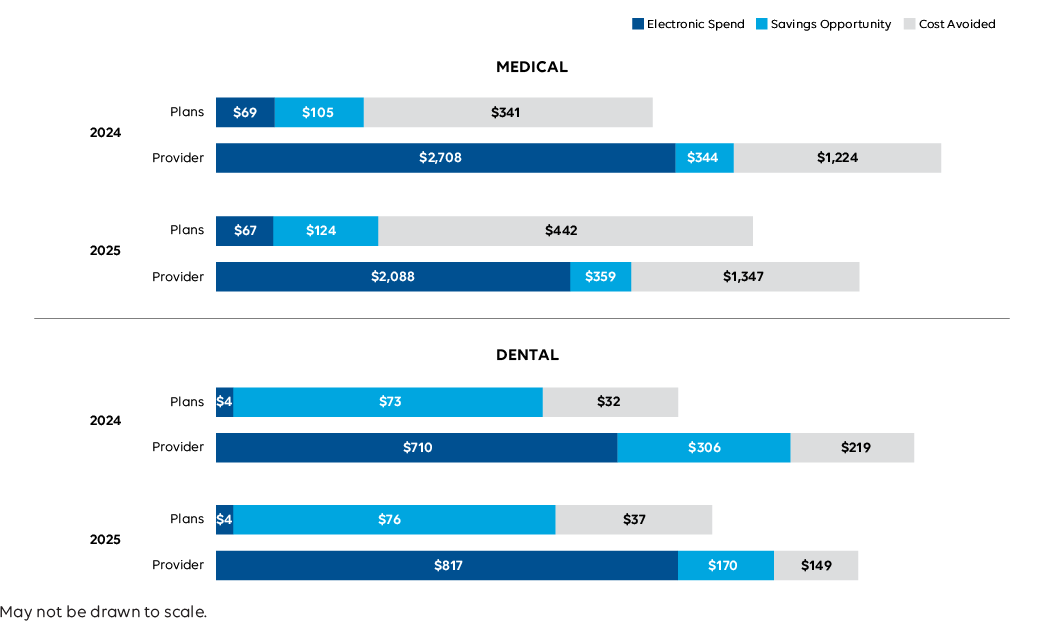

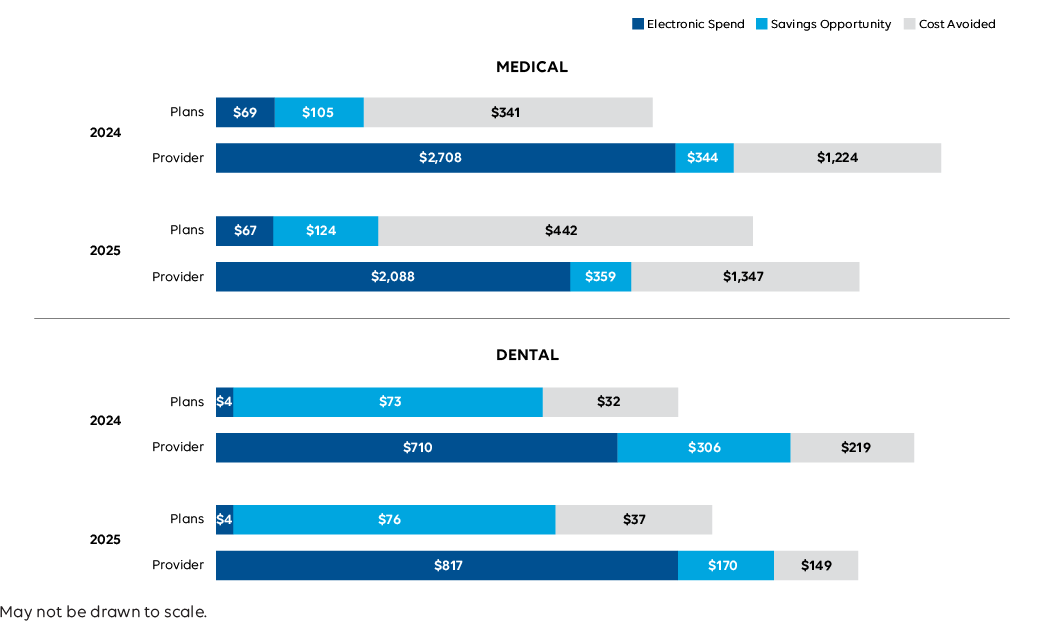

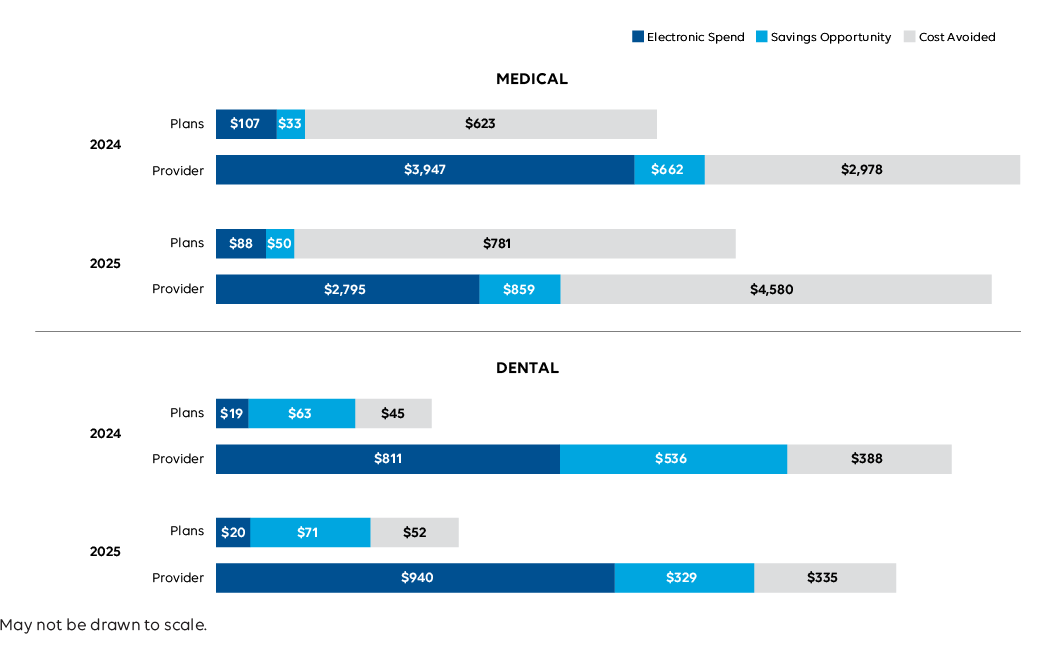

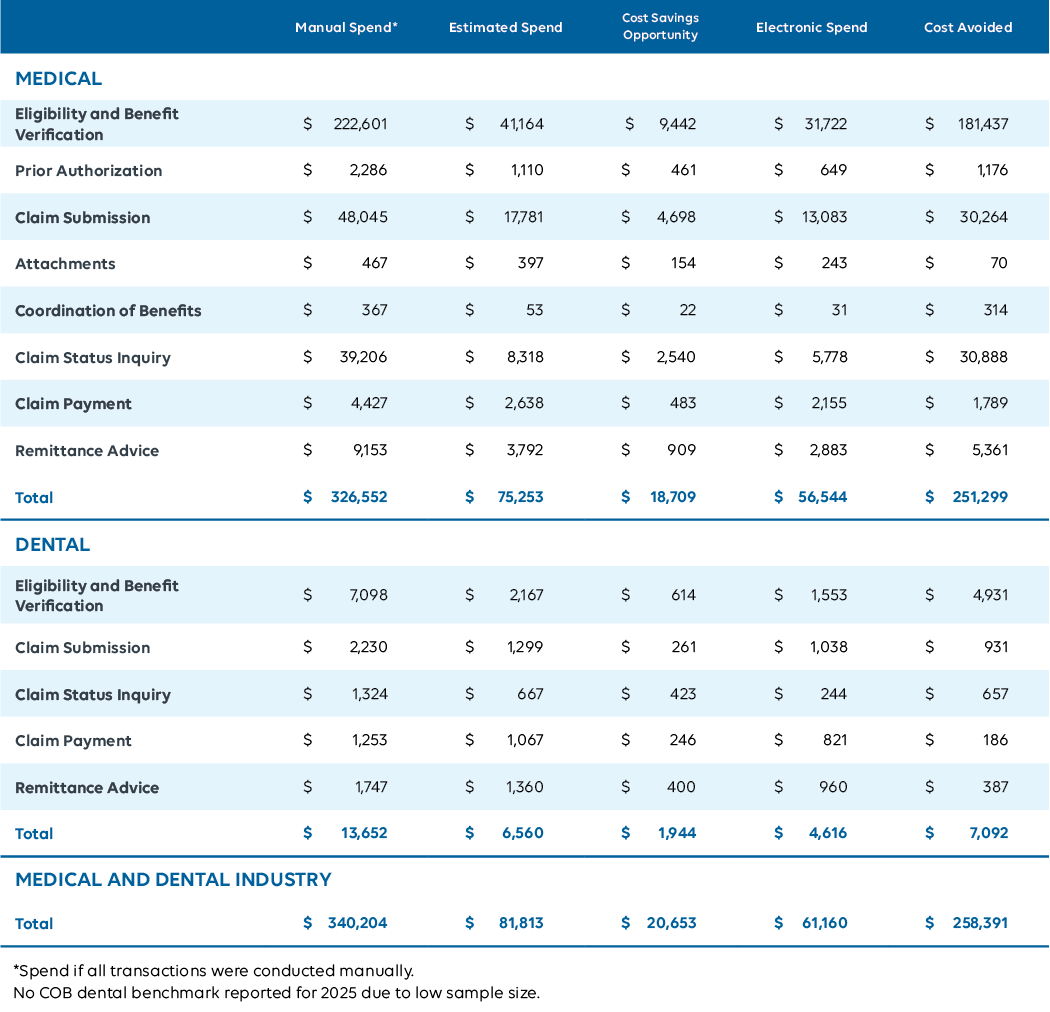

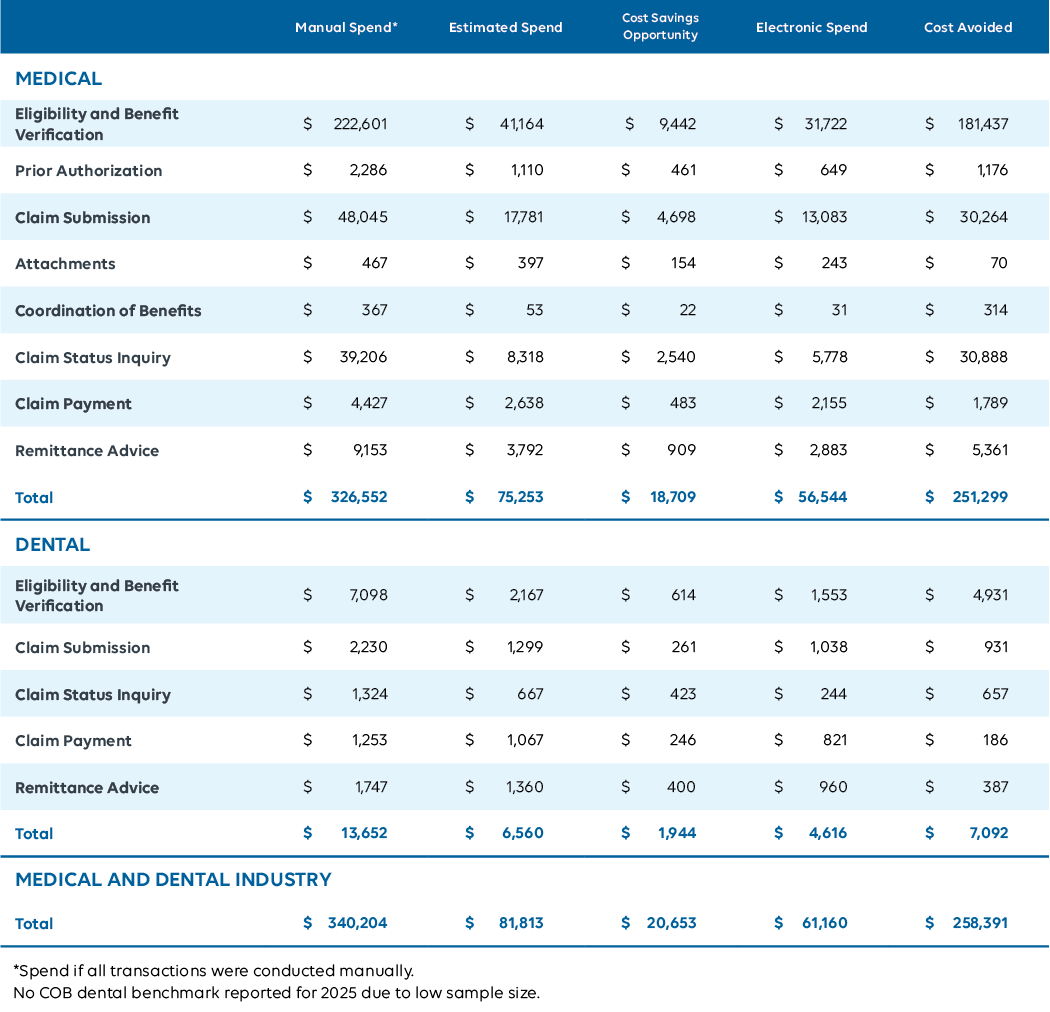

Administrative Spend

Administrative spending declined across both industries despite the year’s disruptions, signaling improved efficiency and cost management.

Higher electronic volumes and lower per- transaction costs helped offset the temporary manual workarounds required during recovery, demonstrating the value and durability of automated processes.

-9% to

$75B

Medical spending decreased.

-4% to

$6.6B

Dental spending decreased.

Industry Impact: Lower administrative spend means fewer resources diverted from patient care and less financial strain on providers. Even during disruption, automation helped control costs and limit the impact of manual workarounds. For patients, this translates to fewer billing errors and a more predictable experience. The takeaway is clear: sustained investment in automation protects both affordability and access when the system is under stress.

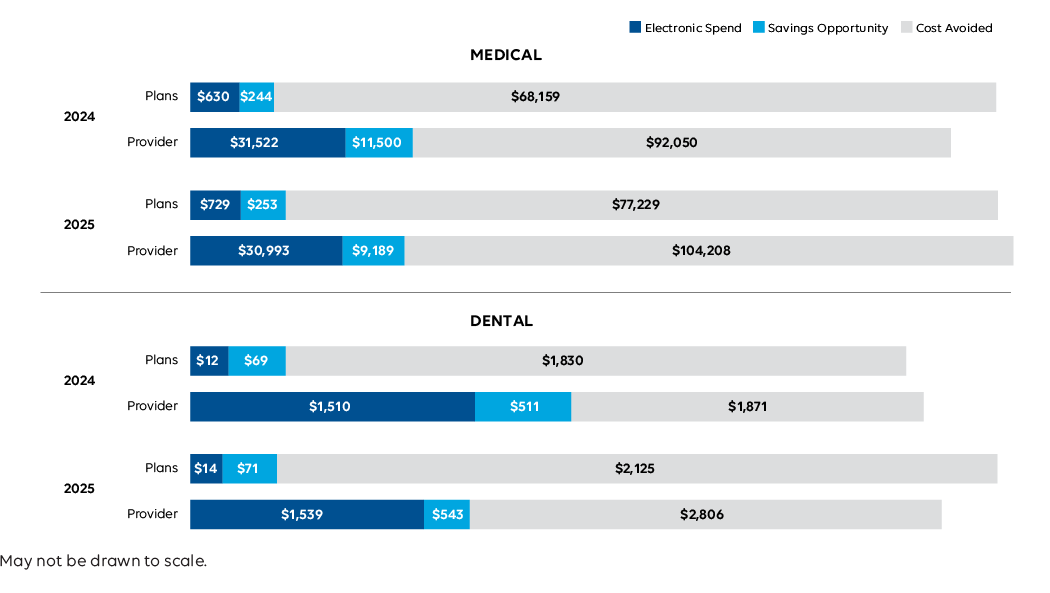

Medical and Dental Industry Estimated National Spend

2023-2025 CAQH Index (in billions)

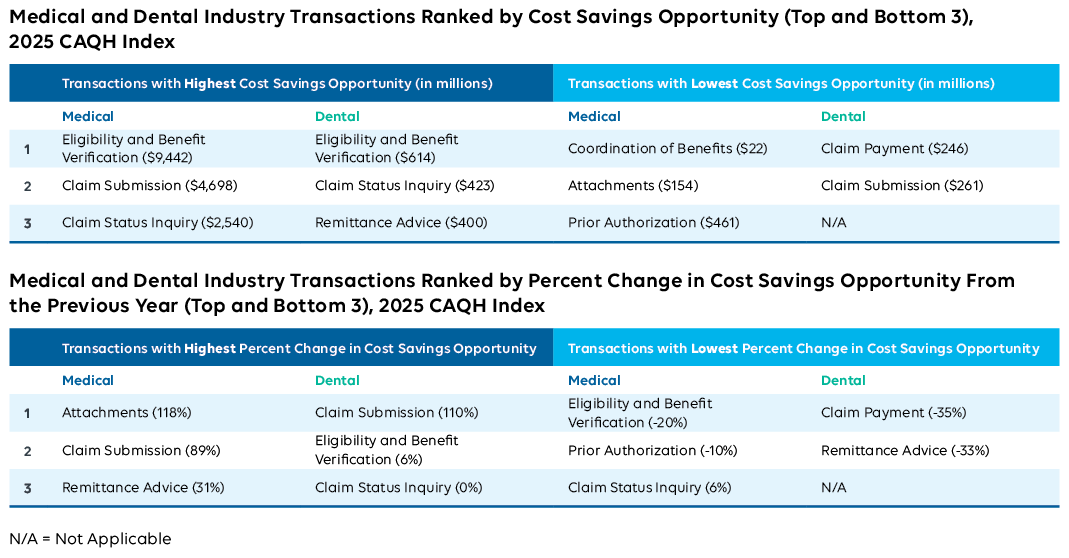

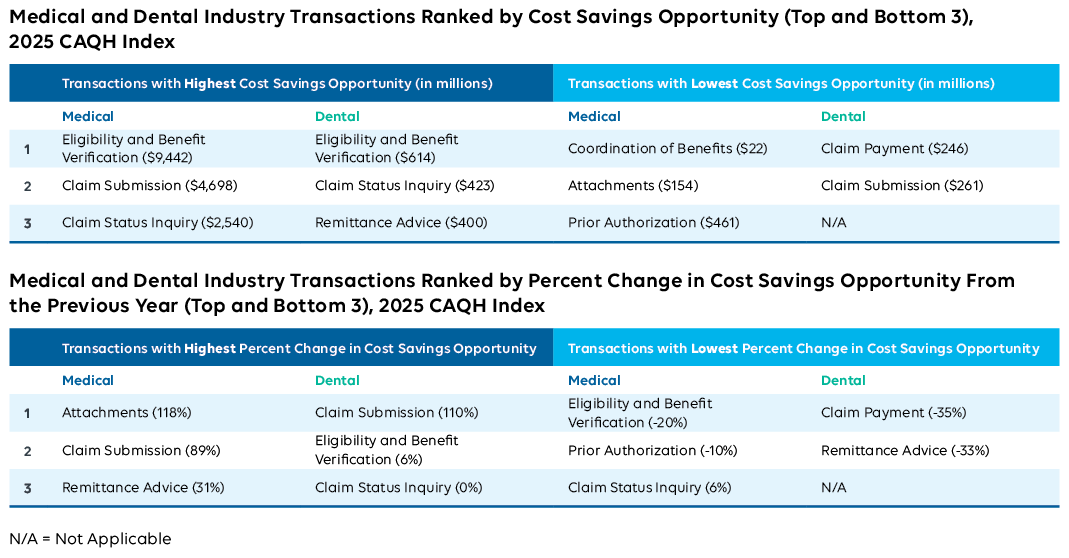

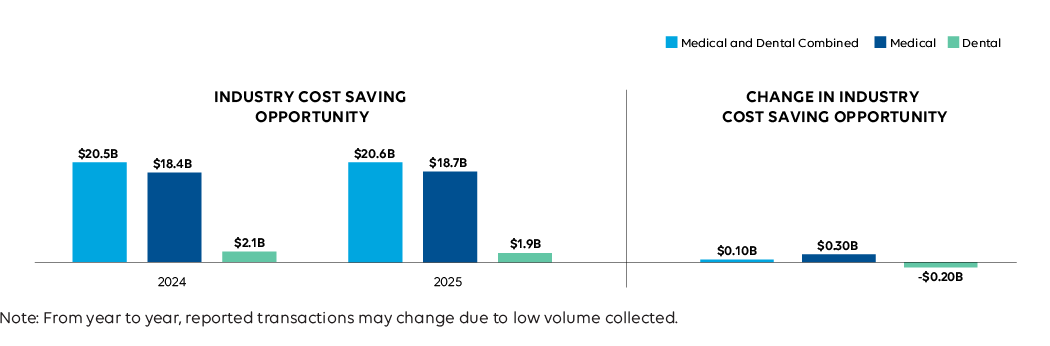

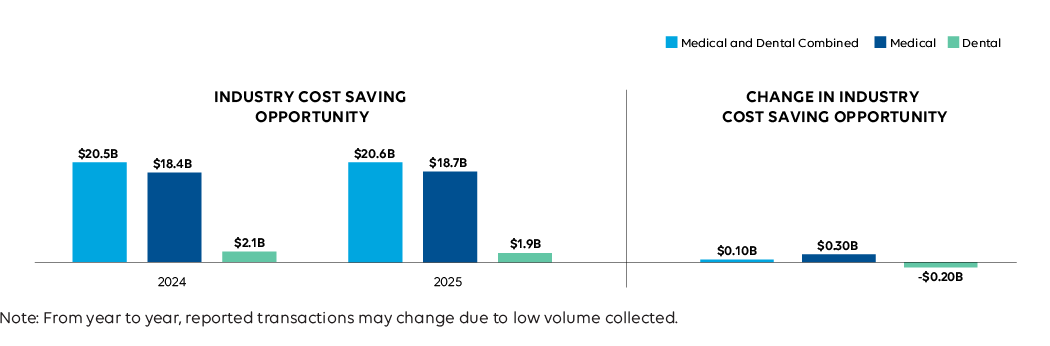

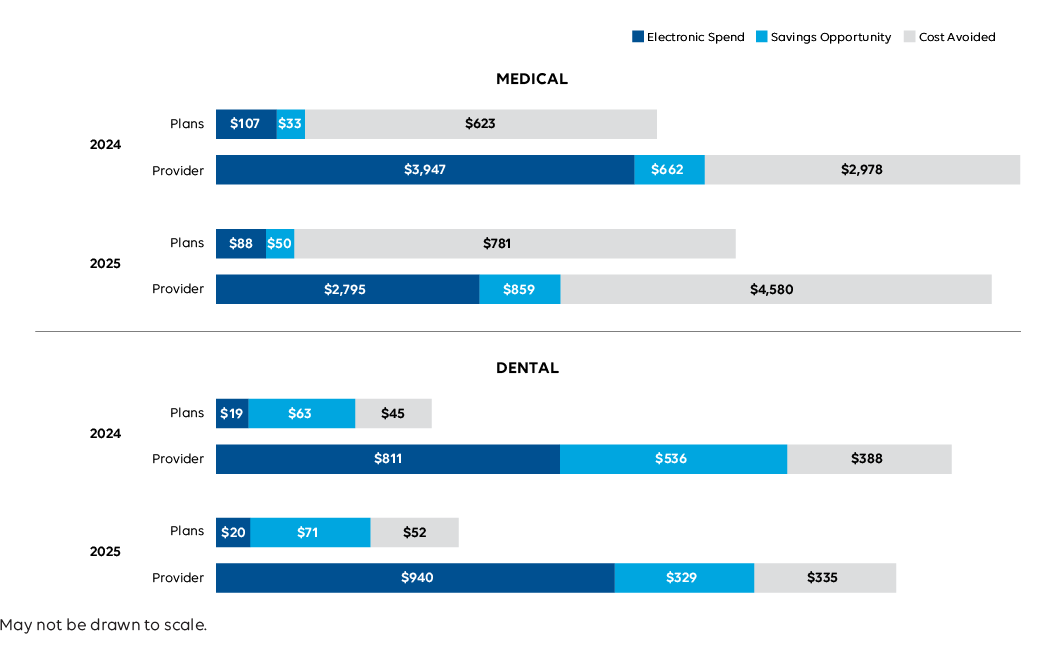

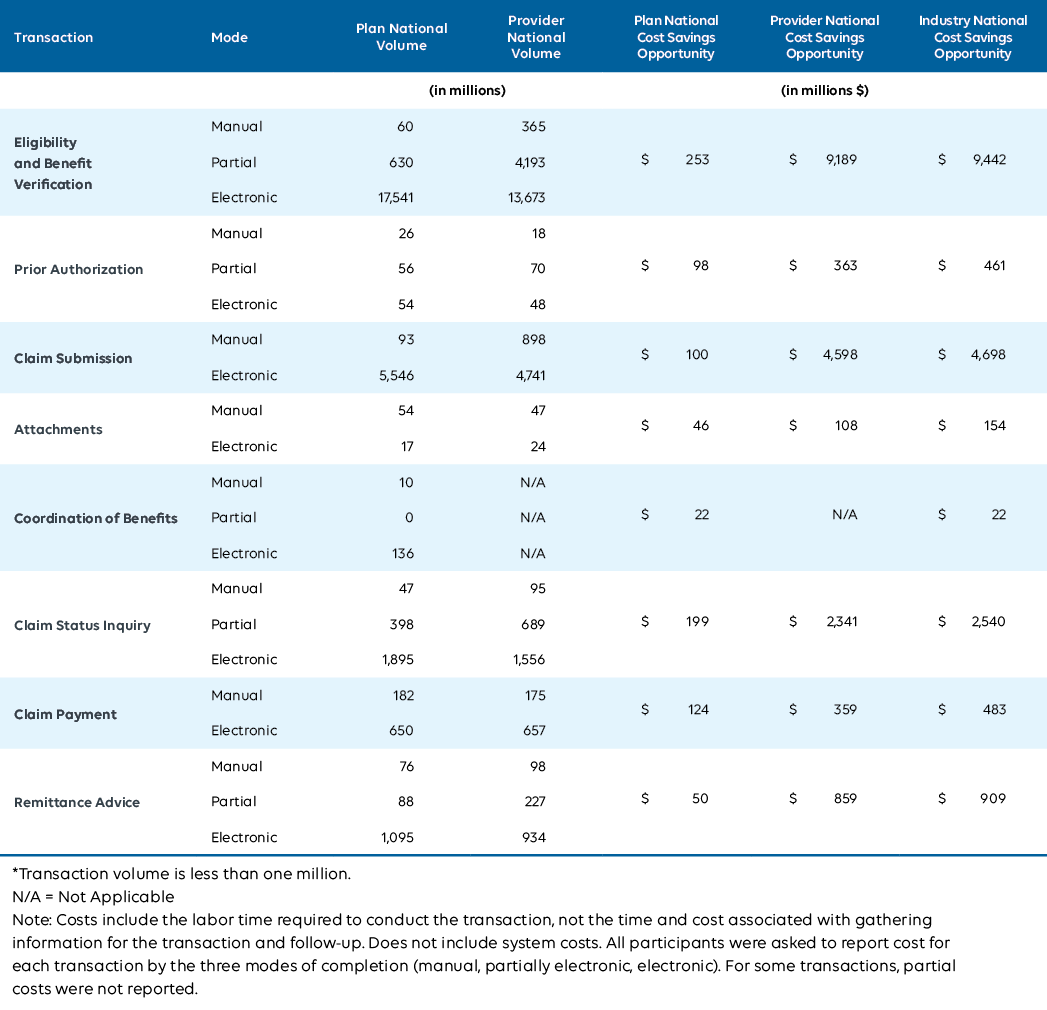

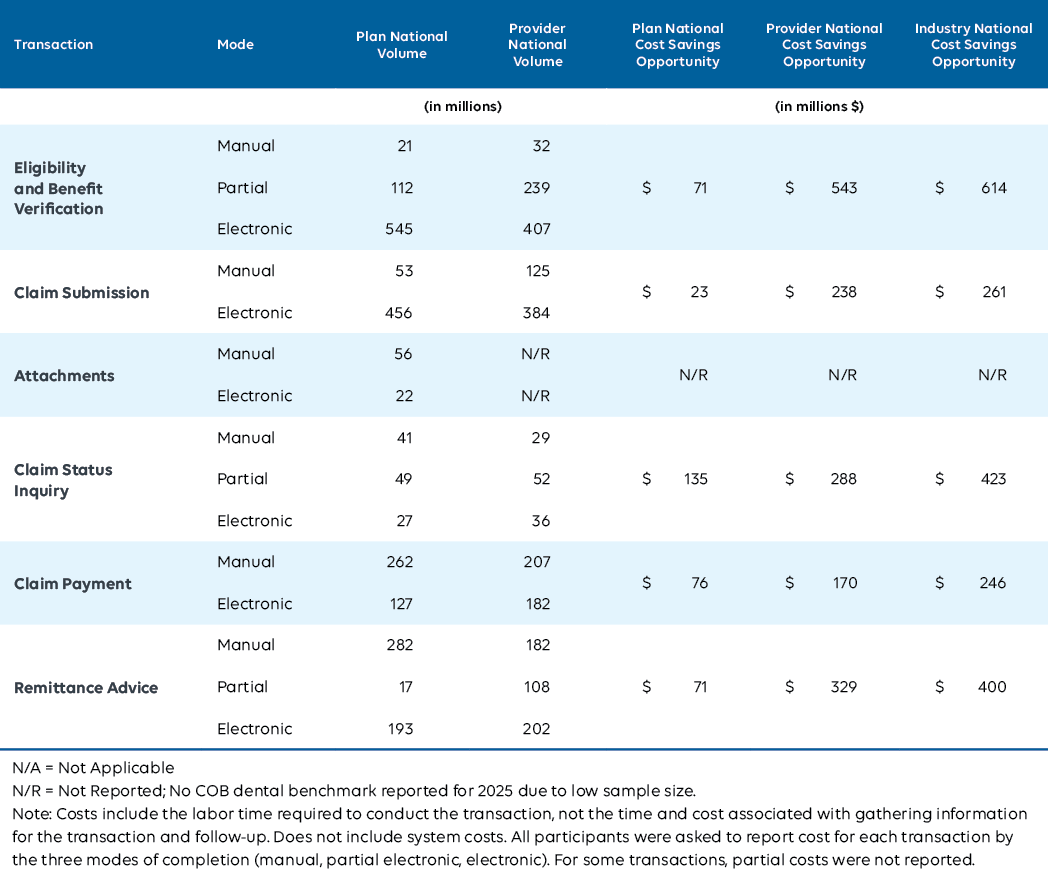

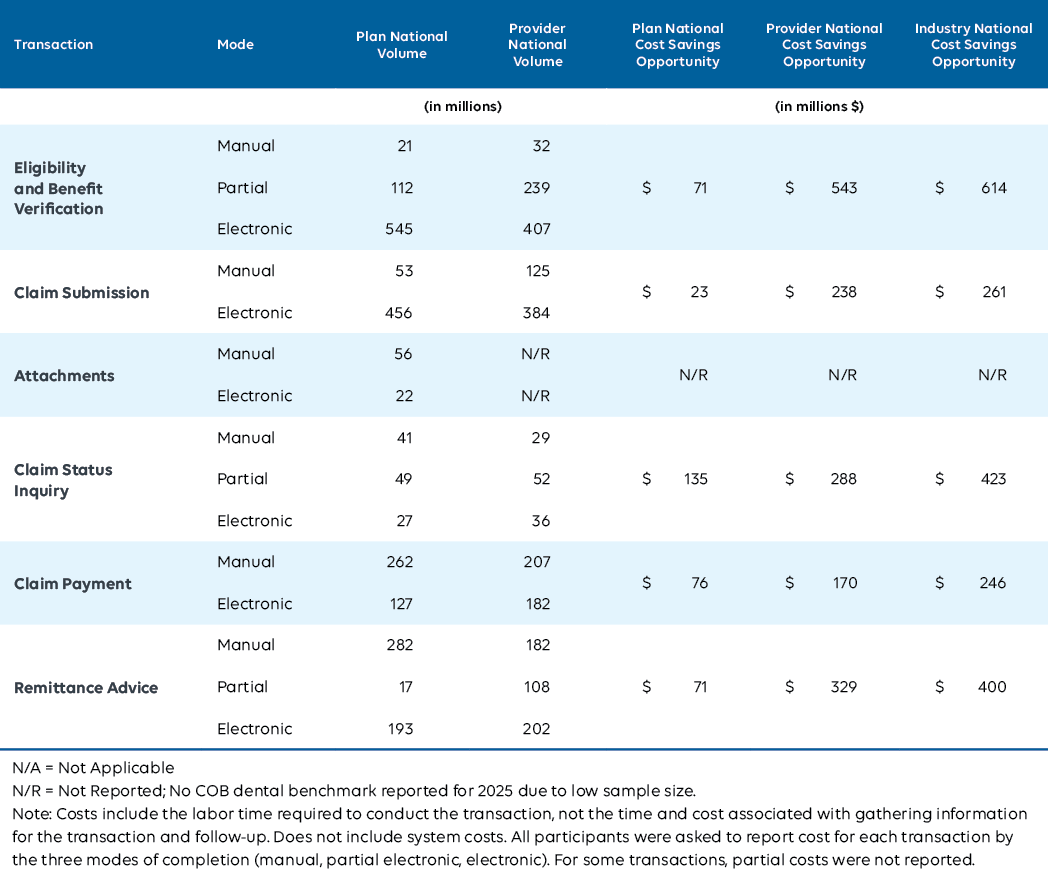

Cost Savings Opportunities

Opportunities for further cost savings shifted modestly across industries. In the medical industry, potential savings rose slightly due to increased costs and volumes for certain manual processes, such as submitting a claim impacted by the cyberattack. In dental, lower transaction costs across modes reduced the overall savings opportunity.

+2% to

$18.7B

Medical industry cost savings opportunity increased slightly.

-8% to

$1.9B

Dental industry cost savings opportunity decreased.

Industry Impact: Stable savings opportunities signal that automation is already reducing costs for providers and limiting disruption for patients. The real opportunity now is not just finding new savings, but protecting the efficiencies that keep care affordable and billing manageable when disruptions occur.

Medical and Dental Industry Estimated National Cost Savings Opportunity

2023-2025 CAQH Index (in billions)

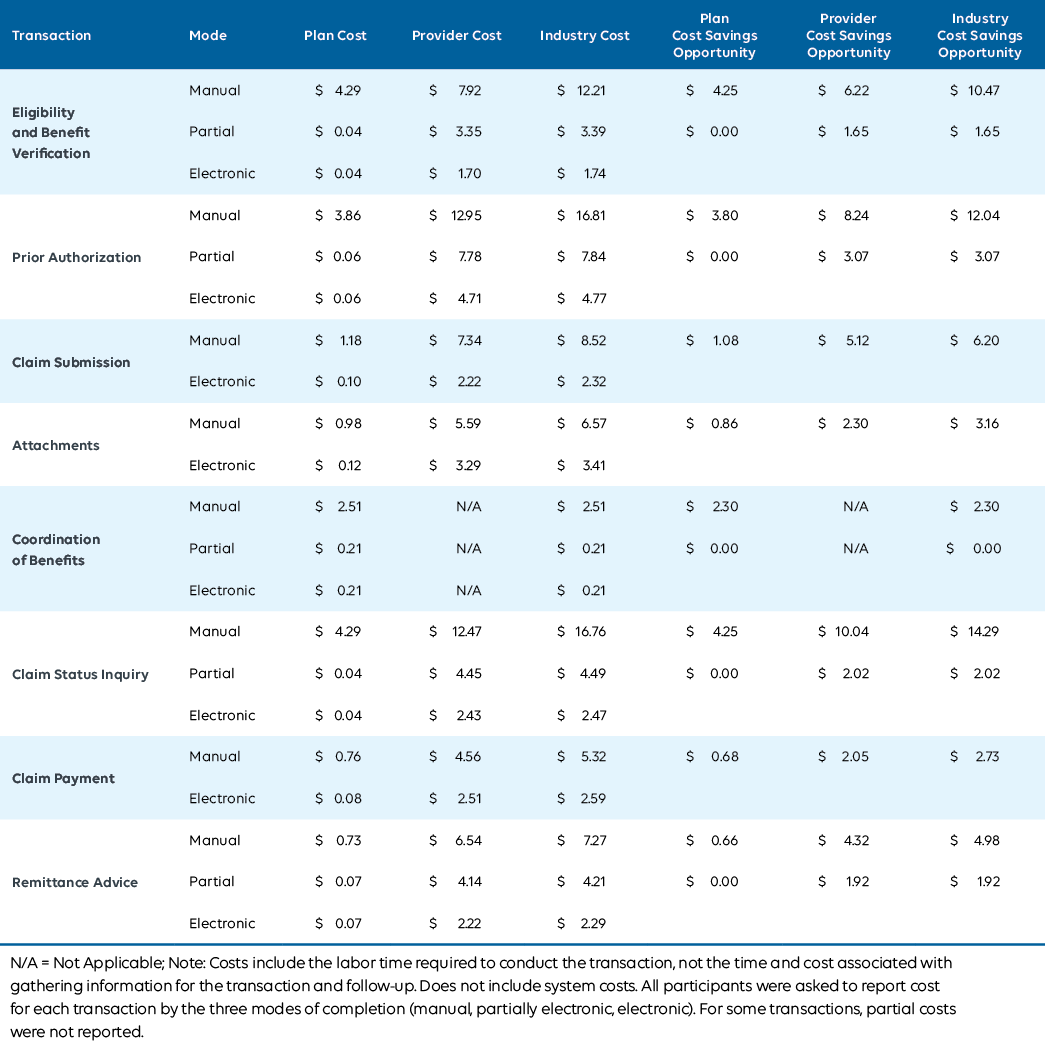

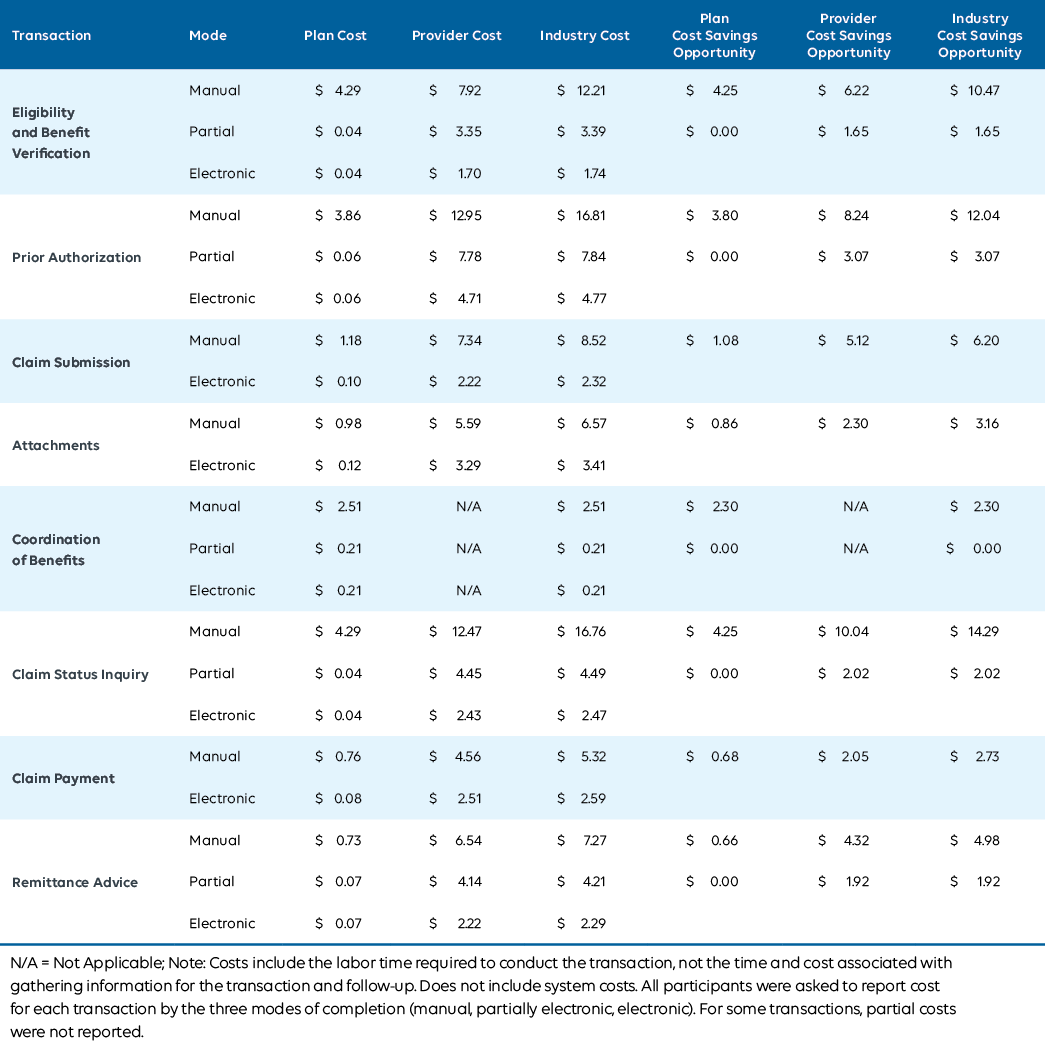

Medical Provider Average Cost per Transaction for Electronic and Manual Transactions

2023-2025 CAQH Index

Industry Call to Action

The 2025 CAQH Index reflects a year of recovery and resilience. The 2024 Change Healthcare cyberattack18 tested the systems that keep healthcare running, and the industry adapted. Providers and payers rerouted transactions and restored automated connections, avoiding $258 billion in administrative costs, a 17 percent increase from the previous year.

That recovery demonstrates what’s possible when the industry works together, turning disruption into progress toward greater automation, stronger data security, and better care for patients.

Now is the time to build on that momentum. By applying the lessons learned, we can accelerate automation, advance interoperability, and strengthen the systems that connect us all.

What the Industry Can Do:

- Strengthen Cybersecurity

Protecting healthcare data and systems is essential to keeping care uninterrupted. The Change Healthcare cyberattack showed how one incident can ripple across the industry, halting electronic workflows. In response, two-thirds of medical and dental plans and over one-third of providers enhanced or increased security protocols to reduce risk.19

The need to strengthen redundancy and backup mechanisms was emphasized.20,21 By maintaining alternate systems and secure copies of information, organizations can recover more quickly and continue delivering reliable care even when primary systems are compromised. Ongoing investment and coordination will help safeguard patients and ensure the healthcare system remains resilient and dependable. - Advance Interoperability and Demonstrate Value

Compliance is just the starting point. As the industry transitions to FHIR-based data exchange, real progress means aligning workflows and priorities across providers, payers, and vendors. Nearly one-third of medical plans cited legacy systems and inconsistent standards as top barriers, while all dental plans pointed to resource limitations.* Addressing these challenges will unlock more automation and make data more actionable.

Demonstrating value is just as important. Over two-thirds of medical and dental plans identified peer benchmarks and return on investment (ROI) data as critical for guiding priorities and evaluating impact in 2025.* Clear evidence of ROI helps organizations focus on solutions that deliver measurable benefits, driving adoption even under budget constraints. - Leverage Artificial Intelligence (AI)

AI is moving from concept to everyday practice. More than half of plans and one-quarter of providers now use AI, with provider use focused on administrative tasks such as eligibility checks, note-taking, and patient communications. Dental providers are also increasingly using AI for clinical tasks, including interpreting X-rays and lab results. As confidence in AI tools grow, these technologies will further reduce manual work, streamline operations, and allow staff to focus more on patient care.

By continuing to collaborate, the industry can build a healthcare system that’s more connected, data-driven, and efficient. Together, we can use technology to strengthen care and create lasting progress.

Turn Insight into ROI with Index Pro

Access interactive analytics, on-demand ROI tools, and expert support available only in Index Pro.

- Visualize what’s possible. Explore an interactive chartbook with transaction-level and financial data.

- Quantify your savings. Use the ROI calculator to uncover your real cost-reduction opportunities.

- Get tailored support. Tap into 1-hour of consulting to shape your automation strategy.

- Stay ahead. Access emerging data on FHIR, interoperability, and AI before anyone else.

Click here to start your Index Pro experience.

* Data represents findings from supplemental Index questions. Additional insights will be released as part of Index Pro in Q2 2026.

Acknowledgments

The following organizations and individuals contributed to the success of the 2024 CAQH Index:

- Participating medical and dental plans and providers for submitting their data and completing follow-up interviews.

- NORC at the University of Chicago for data collection and analytics.

- CAQH Index Advisory Council for their continued guidance and support of the CAQH Index research

| 2025 CAQH Index Advisory Council Member |

Organization |

|---|---|

| Amy King | Blue Cross Blue Shield of Michigan |

| Amy Neves | Aetna |

| Brad Smith | Nacha |

| Cat Douglas | Florida Blue |

| Cathy Sheppard | X12 |

| Erin O'Rourke | Advancing Health Insurance Providers’ Strategic Priorities (AHIP) |

| Geanelle Herring | Centers for Medicare & Medicaid Services (CMS) |

| Heath Hanwick | Epic |

| Heather McComas | American Medical Association (AMA) |

| Jay Eisenstock | JE Consulting |

| Lorraine Doo | Centers for Medicare & Medicaid Services (CMS) |

| Mahesh Siddanati | Centene |

| Margaret Weiker | National Council for Prescription Drug Programs (NCPDP) |

| Paul Keyes | Cigna |

| Rebekah Fiehn | American Dental Association (ADA) |

| Robert Tennant | Workgroup for Electronic Data Interchange (WEDI) |

| Sofia Fayazdeen | UnitedHealthcare (UHC) |

| Stanley Nachimson | Nachimson Advisors |

| Suzanne Lestina | University of Chicago Medical Center (UChicago Medicine) |

| Tab Harris | Florida Blue |

| Terrence Cunningham | American Hospital Association (AHA) |

| Tom Mort | Vyne Dental |

| Viet Nguyen | Health Level Seven International (HL7 International) |

Endnotes

Overview

1 Ransomware_Attacks_Surge_in_2023.pdf | DNI.gov.

2 Health-ISAC_2025-Annual-Threat-Report.pdf | Health-ISAC.

3 New numbers from the Change Healthcare data breach: 193 million affected | Healthcare IT News.

4 The Biggest Healthcare Data Breaches of 2024 | The HIPAA Journal.

5 Change Healthcare Cybersecurity Incident FAQs | HHS.gov.

6 Change Healthcare cyberattack impact: Key takeaways from informal AMA follow-up survey | AMA.

7 The Change Healthcare Cyberattack and Response Considerations for Policymakers | Congress.gov.

8 Change Healthcare Cyberattack Underscores Urgent Need to Strengthen Cyber Preparedness for Individual Health Care Organizations and as a Field | AHA.

9 HHS Letter and Appendix to Health care Providers — Change Healthcare Cyberattack | AMA.

10 Ibid.

11 ADA continues response to Change Healthcare cyberattack | ADA.

12 Change Healthcare/Optum Payment Disruption (CHOPD) Accelerated Payments to Part A Providers and Advance Payments to Part B Suppliers | CMS.

13 Hospital payments have been substantially affected by the Change Healthcare cyberattack, report finds | HFMA.

14 UnitedHealth unit will start processing $14 billion medical claims backlog after hack | Reuters.

15 CMS Interoperability and Prior Authorization Final Rule (CMS-0057-F) | CMS.

16 Interoperability and Prior Authorization Final Rule (CMS-0057-F), Federal Register: Medicare and Medicaid Programs; Patient Protection and Affordable Care Act; Advancing Interoperability and Improving Prior Authorization Processes for Medicare Advantage Organizations, Medicaid Managed Care Plans, State Medicaid Agencies, Children’s Health Insurance Program (CHIP) Agencies and CHIP Managed Care Entities, Issuers of Qualified Health Plans on the Federally-Facilitated Exchanges, Merit-Based Incentive Payment System (MIPS) Eligible Clinicians, and Eligible Hospitals and Critical Access Hospitals in the Medicare Promoting Interoperability Program | Federal Register.

17 Federal Register: 21st Century Cures Act: Interoperability, Information Blocking, and the ONC Health IT Certification Program | ONC.

Industry Call to Action: From Insight to Impact

18 Change Healthcare Cybersecurity Incident FAQs | HHS.gov.

19 The CAQH Index Report | CAQH.

20 Hard lessons learned from Change Healthcare breach | AMA.

21 A year since the Change Healthcare breach, what have we learned? | Healthcare IT News.

- IN THIS SECTION

- Overview

- Key Terms

- Administrative Workflow

- Key Findings

- Industry Call to Action

- Acknowledgements

- Endnotes

Introduction

Understanding how administrative tasks move through the healthcare system is essential to improving them. The CAQH Index measures this activity each year so the industry can see

where progress is being made and where opportunity remains. By tracking the adoption of electronic transactions and comparing them to manual and partially electronic processes, the Index shows how much time and money the system can save when workflows are modern, reliable, and efficient.

The 2025 CAQH Index is our thirteenth annual report and reflects data from medical and dental plans and providers representing more than half of the insured population in the United States. To build a clear and accurate picture, we worked with organizations across the country through direct outreach, industry events, and collaboration with NORC at the University of Chicago. Participants included long-standing contributors and new partners engaged in CAQH initiatives.

This methodology outlines how the data was collected, how transaction volumes and spending were calculated, and how we assessed cost savings opportunities. Our goal is to make the process transparent and accessible so readers can understand both the strength of the findings and the shared effort behind them.

Background

The CAQH Index tracks the industry adoption of electronic administrative transactions over time. It measures industry volume, spend, cost avoided, and the cost savings opportunity associated with switching from conducting partially electronic and manual transactions to using fully electronic transactions. The 2025 CAQH Index is the thirteenth annual report which collects data from medical and dental plans and providers covering more than half of the insured United States population, according to enrollment reports from the AIS Directory of Health Plans and NADP Dental Health Plan Profiles.1,2

Recruitment

Data Collection

The CAQH Index collected data through a voluntary online survey tool from June to September 2025. A fillable PDF and Excel version of the survey were also offered to participants. Plan and provider data are representative of the 2024 calendar year, January 1 to December 31, 2024. The medical and dental plan surveys collected data on nine administrative transactions. For providers, data was collected for 10 medical and eight dental transactions.

Supplemental Questions

The medical and dental plan survey also included supplemental questions regarding:

- Use of proprietary reports for Acknowledgements.

- Use of artificial intelligence (AI) for administrative and clinical tasks.

- Preparation for the Interoperability and Prior Authorization Final Rule4 — implementation of electronic prior authorization (ePA) (Medical plans only).

- Value of conflict-of-interest data.

- Payer/provider contracting process.

The medical provider survey collected data on eight administrative transactions and two pharmacy transactions, Prescription/Drug Prior Authorization (NCPDP SCRIPT) and Realtime Pharmacy Benefit Prescription Check (NCPDP RTPB) while the dental provider survey included eight administrative transactions.

For medical and dental providers, this year’s survey included supplemental questions regarding:

- Use of proprietary reports for Acknowledgments.

- Average number of Eligibility and Benefit Verification checks per patient per visit.

- Role within the practice (clinical or administrative).

- Use of the NCPDP drug formulary and benefit standard (Medical providers only).

- Use of artificial intelligence (AI) for administrative and clinical tasks.

- Preparation for the Interoperability and Prior Authorization Final Rule5 — implementation of electronic prior authorization (ePA) (Medical plans only).

- Payer/provider contracting process.

Imputations

To ensure that responses were accurate, logic checks were embedded in the online survey tool for plans and providers to check for data reliability and accuracy for all transactions. Logic checks included a request for additional information if estimates were outside specified bounds. For example, in the provider surveys, if electronic times were three minutes or more, participants were asked to provide an explanation of the process. For the 2025 Index, the provider surveys saw increased incidents of low-quality and potentially fraudulent submissions. Quickly detected as a concern, targeted adjustments were made to both the survey process and the dataset to preserve the accuracy and reliability of the results:

- The survey was limited to only accept responses from US-based IP addresses.

- Additional bot detection technology and security-scan monitoring were implemented.

- Cases were flagged as suspicious using a combination of clinic name, contact name, email address, phone number, location, IP address, completion time, and overall number of questions answered with non-missing information. Additionally, cases with unusually high or low transaction volumes relative to number of staff were reviewed. All reviews were conducted both by project staff and through use of Microsoft’s Copilot LLM.

- Fraudulent cases included:

- Duplicate names, email addresses, or phone numbers with more than 2 records or other detected issues

- Near duplicate names, email addresses, or phone numbers (e.g., email addresses with a single changed digit)

- Irrelevant information in required fields, such as clinics which listed impossible physical addresses instead of contact names

- Notable hospitals or clinics without other identifying business information

- Unusually high or low transaction volumes relative to staff size

- Unusually high staff pay relative to transaction volume

- All cases with unusual transaction or pay data were contacted for clarification on transactions, and several were determined to be genuine, including the risk of false positive identification was nonzero.

- Some additional cases with suspicious but not obviously fraudulent data were contacted to confirm clinic details. Any case which did not respond or was unable to provide matching clinical information was removed from the dataset.

- Fraudulent cases included:

Even with logic checks, some responses were insufficient or out of range. When this occurred, NORC followed up with respondents to obtain more information about the relevant transactions. If clinics did not respond or were unable to provide sufficient additional information, values were imputed using the following rules.

- For processing time values, if a respondent provided information that was greater than the median value plus the Interquartile Range multiplied by 2, the processing time was imputed using the median value plus the Interquartile Range multiplied by 2. In cases where partial time was the same as manual time, partial time was imputed.

- For salary values, if a respondent provided information that was greater than the median value plus the Interquartile Range multiplied by 3, the salary time was imputed with the median value plus the Interquartile Range multiplied by 3. In cases where the reported salary was less than the Median-Interquartile Range, the salary was imputed to the Median-Interquartile Range, or $20,000, whichever was lower.

- Medical plans represented 217 million covered lives, or 63 percent of the United States enrolled population. Medical plans accounted for 4 billion claims received and 20 billion transactions annually. In comparison, dental plans represented 118 million covered lives and approximately 40 percent of the enrolled population. Dental plans represented a smaller portion of volume with 205 million claims received and a total of 915 million transactions.

Overview of Fully Electronic Administrative Transactions Studied, 2025 CAQH Index:

| Transaction | Transaction Standard | Definition |

|---|---|---|

| Eligibility and Benefit Verification† | ASC X12N 270/271 | An inquiry from a provider to a health plan or from one health plan to another to obtain eligibility, coverage or benefits associated with the plan and a response from the health plan to the provider. Does not include referrals (applicable only to providers). |

| Prior Authorization | ASC X12N 278 | A request from a provider to a health plan to obtain authorization for healthcare services or a response from a health plan for an authorization. Does not include referrals. |

| Claim Submission | ASC X12N 837 | A request to obtain payment or transmission of encounter information for the purpose of reporting delivery of healthcare services. |

| Attachments | ASC X12N 275, HL7 CDA* | Additional information submitted with claims for payment, claim appeals or prior authorization, such as medical records to support a claim or to explain the need for a procedure or service. |

| Acknowledgements** | ASC X12N 277CA/999 | A health plan’s response to a provider or provider’s clearinghouse that they received information from the provider or clearinghouse; or confirmation received by a provider that the information shared with a health plan has been rejected or accepted. |

| Coordination of Benefits | ASC X12N 837 | Claims that are sent to secondary payers with explanation of payment information from the primary payer to determine remaining payment responsibilities. |

| Claim Status Inquiry† | ASC X12N 276/277 | An inquiry from a provider to a health plan to determine the status of a health care claim or a response from the health plan. |

| Claim Payment† | NACHA Corporate Credit or Deposit Entry with Addenda Record (CCD+) |

An electronic funds transfer (EFT) from a health plan’s bank to a provider’s bank; including payment and data specific to the payment. |

| Remittance Advice† | ASC X12N 835 | The transmission of explanation of benefits or remittance advice from a health plan to a provider explaining a payment. |

† Both HIPAA standards and CAQH CORE Operating Rules are federally mandated.

* ASC X12N 275 and HL7 CDA are both industry recognized standards for electronic attachments.

** The reporting of Acknowledgements has been retired after achieving consistent 100% electronic adoption; data is included in

total volume for trend analyses.

Medical plans represented 217 million covered lives, or 63 percent of the United States enrolled population. Medical plans accounted for 4 billion claims received and 20 billion transactions annually. In comparison, dental plans represented 118 million covered lives and approximately 40 percent of the enrolled population. Dental plans represented a smaller portion of volume with 205 million claims received and a total of 915 million transactions.

Basic Characteristics of Data Contributors, 2019-2025 CAQH Index:

| 2019 Index | 2020 Index | 2021 Index | 2022 Index | 2023 Index | 2024 Index | 2025 Index | |

|---|---|---|---|---|---|---|---|

| MEDICAL | |||||||

| Plan Members (total in millions) | 154 | 167 | 202 | 204 | 209 | 216 | 217 |

| Proportion of Total Enrollment (%) | 47 | 51 | 61 | 60 | 60 | 63 | 63 |

| Number of Claims Received (total in billions) | 2 | 2 | 2 | 3 | 3 | 3 | 4 |

| Number of Transactions (total in billions) | 8 | 10 | 12 | 14 | 15 | 17 | 20 |

| DENTAL | |||||||

| Plan Members (total in millions) | 111 | 112 | 116 | 126 | 127 | 136 | 118 |

| Proportion of Total Enrollment (%) | 44 | 43 | 44 | 48 | 45 | 47 | 40 |

| Number of Claims Received (total in billions) | 185 | 186 | 156 | 201 | 199 | 223 | 205 |

| Number of Transactions (total in billions) | 726 | 740 | 703 | 828 | 851 | 967 | 915 |

Metrics

Results were aggregated to ensure data privacy. Benchmarks were calculated and reported only for transactions where three or more plans participated. The following metrics were reported for each transaction:

Adoption Rate — The degree to which medical and dental plans and providers complete transactions using fully electronic, partially electronic, or manual modes. Adoption rates are calculated using only medical and dental plan reported volumes.

Estimated Volume — The number of fully electronic, partially electronic, and manual administrative transactions reported by medical and dental plans and providers weighted to a national level.

Cost Per Transaction — The labor costs (e.g., salaries, wages, personnel benefits, and related overhead costs) associated with full electronic, partially electronic, and fully manual transaction as reported by medical and dental plans and providers. Costs include the labor time required to conduct the transaction, not the time and cost associated with gathering information for the transaction and follow-up. Costs do not include system costs (e.g., maintaining, building, or buying software or other equipment).

Administrative Spend (Estimated Spend) — The amount that medical and dental plans and providers spend conducting an administrative transaction in total and by modality.

Cost Avoided — The amount that medical and dental plans and providers have saved by not conducting transactions using partially electronic or fully manual modes.

Cost Savings Opportunity — The administrative cost savings that could be achieved by switching the remaining partially electronic and manual transactions to fully electronic transactions.

Time to Conduct — The time required for providers to conduct a fully electronic, partially electronic and fully manual transaction.

Time Savings Opportunity — The time that providers could save by switching partially electronic and manual transactions to fully electronic transactions.

Adoption Rate

The degree to which medical and dental plans and providers complete transactions using fully electronic, partially electronic, or manual modes. Adoption rates are calculated using only medical and dental plan reported volumes. Transaction adoption is classified into three modes:

Fully Electronic — Administrative transactions conducted using a HIPAA-mandated standard, unless otherwise specified.

Partially Electronic — Administrative transactions conducted using web portals and interactive voice response (IVR) systems.

Fully Manual (Manual) — Administrative transactions requiring end-to-end human interaction such as telephone, mail, fax, and email.

For the figures depicting the medical and dental plan adoption rates, adoption rates were calculated by mode as a proportion of the total volume reported by plans and represent the percent distribution of transactions conducted by mode.

Adoption Rate (per mode) = Volume Reported by Plans (per mode) / Total Volume Reported by Plans

The annual percentage point change is computed as the arithmetic difference between percentages.

Provider Weights

Medical and dental provider results are weighted to provide representative estimates of the medical and dental provider populations.

For medical providers, results are estimated based on the size and type of practice as well as specialty of the responding provider. The groups were defined using the American Medical Association (AMA) Benchmark Practice Survey6 and the AAMC Physician Specialty Data Report.7 The distribution of providers in the population was determined using active and self-attested MD/DO information contained within CAQH’s Provider Data Portal.8 Size and type of practice included: Less than 5 physicians, 5-50+ physicians, and hospitals. Specialty groups included: Generalist, Specialist, Behavioralist, and Hospitalist.

For dental providers, results are estimated based on the provider’s practice size and Dental Support Organization (DSO) affiliation status. The distribution of providers in the population was determined using the American Dental Association (ADA) Survey of Dental Practice.9 The distribution of dental providers was split into 3 groups: non-DSO affiliated solo practice, DSO affiliated solo or group practice, and non-DSO affiliated group practice.

The following table shows the percent of the medical provider population represented in each group:

| Specialty | Size | Percent |

|---|---|---|

| Generalist | 1-4 | 25.6% |

| Generalist | 5-50+ | 18.9% |

| Specialist | 1-4 | 19.2% |

| Specialist | 5-50+ | 17.8% |

| Behavioralist | 1-4 | 3.1% |

| Behavioralist | 5-50+ | 2.3% |

| Hospitalist* | Hospital | 13.1% |

The following table shows the percent of the dental provider population represented in each group:

| Type of Entity | Percent |

|---|---|

| Non-DSO Affiliated Solo Practice | 28.0% |

| DSO Affiliated Solo or Group Practice | 8.3% |

| Non-DSO Affiliated Group Practice | 63.7% |

| Total | 100% |

Provider weights were calculated by dividing the percent of the sample in each group by the percent of the population in each group as defined by the CAQH’s Provider Data Portal and the ADA. Since not all providers submit data for every transaction, provider weights were calculated individually for each transaction.

Provider Weight (per transaction) = Percentage of the Sample in Each Group Reporting the Transaction / Percentage of the Population in Each Group

Estimated Volume

Plan Estimated Volume

The total transaction volume is estimated based on the proportion of covered lives represented by participating medical plans using the AIS Directory of Health Plans or reported enrollment for medical plans, whichever value was higher. For dental plans the plan reported enrollment was used for estimation. To determine the percent of covered lives represented, the total enrollment from the AIS Directory of Health Plans10 was used for medical plans and the NADP Dental Health Plan Profiles11 for dental plans. The reporting of Acknowledgments has been retired after achieving consistent 100% electronic adoption; data is included in total volume for trend analyses. The extrapolated national volume for each transaction is calculated by mode as follows for both medical and dental plans:

Extrapolated Plan Volume (per modality) = Volume Reported by Plans / Percent of Covered Lives Represented by CAQH Data Contributors

Provider Estimated Volume

Provider volume is calculated first by determining the percentage of each transaction that was conducted by mode (electronic, partial, or manual) for each provider.

Provider Mode Distribution (per transaction) = Provider Reported Volume for Mode (per transaction) * Provider Reported Volume for All Modes (per transaction)

The provider specific mode distribution was then averaged among providers and weighted by the size and specialty groups listed above.

Average Provider Mode Distribution (per transaction) = Average(Provider Weight (per transaction)* Provider Modality Percentage (per transaction))

To account for small provider cell sizes for some transactions by mode, the plan adoption rate per mode is averaged with the weighted average provider mode distribution. This generates a

single estimated percentage by modality for each transaction.

Provider Distribution (per mode per transaction) = Average(Plan Adoption Rate (per mode per transaction), Average Provider Modality Percentage (per transaction))

Given that each transaction for a plan also occurs for a provider, the national estimated plan volume (by mode) is assumed to be same value as the national estimated provider volume (by mode). To determine the provider volume for each mode, the average provider distribution is multiplied by the national estimated provider volume.

Extrapolated Provider Volume (per modality) = Total Plan Estimated Volume for a Given Transaction* Average Modality Percentage

The industry estimated volume for each transaction is the sum of the plan estimated volume and the provider estimated volume for each mode.

Cost Per Transaction

Transaction costs are reported for fully electronic, partially electronic and manual transactions for medical and dental plans and providers when available depending on sample size. For medical and dental plans, the cost per transaction by mode is a weighted average based on the data submitted by participants reporting a valid result using the proportion of their membership enrollment. The calculation requires both the reporting of a valid transaction volume and transaction cost by a survey participant to be included in the weighted average cost.

For medical and dental providers, weighted average costs per transaction by mode were calculated by NORC based on transaction type, average staff time to conduct a transaction and cost per transaction for each mode. The cost calculation followed a multi-step process to calculate weighted costs per transaction for medical and dental providers:

- The time per transaction by mode and reported salary were averaged using the provider weights stated above, which account for both size and specialization of practice.

Time per Transaction (per mode) = Average(Provider Weight (per transaction)* Provider Reported Time per Transaction (per Mode, in minutes))

Average Salary = Average(Provider Weight (per transaction)* Provider Reported Salary)

- The average loaded salary per minute per mode for each provider was created by multiplying the average salary by a specific loading factor to account for benefit and overhead costs and then dividing that number by minutes in a work year (40 hours/week, 52 weeks/year, or 124,800 minutes).

Loaded Average Salary (per mode per provider, in minutes) = Average Salary * Loading Factor / Minutes in Work Year

- The individual provider loaded cost per transaction per mode was calculated by multiplying the average loaded salary per minute for each responding provider with the average time per transaction by mode among all providers.

Loaded cost (per provider per transaction per mode) = Loaded Average Salary per minute (per mode per provider) * Time per Transaction (per mode, in minutes)

- The average cost per transaction was calculated using the individual provider loaded cost per transaction per mode and the provider weights stated above.

Cost per Transaction (per modality) = Average (Loaded cost (per provider per transaction per mode) * Provider Reported Time per Transaction (per Mode))

Estimated Spend, Cost Avoided and Cost Savings Opportunity

Administrative Spend (Estimated Spend)

Administrative spend (estimated spend) is calculated by multiplying the estimated volume per mode by its respective weighted cost per transaction for medical

and dental plans and providers within a transaction. The total spend per transaction is equal to the sum of spend for each mode per transaction.

Estimated Cost Avoided

The estimated cost avoided is the arithmetic difference between the spend if all transactions were conducted manually and the total estimated spend by transaction. The total manual spend per transaction was computed by multiplying the estimated national volume of all modes by the manual cost per transaction.

Estimated Cost Savings Opportunity

The cost savings opportunity for switching from manual to fully electronic transactions is calculated by multiplying the estimated national volume of manual transactions by the cost per transaction difference between fully electronic and manual transactions for each transaction. The cost savings opportunity for switching from partially electronic to fully electronic transactions is calculated by multiplying the estimated national volume of partially electronic transactions by the cost per transaction difference between the fully electronic and partially electronic transactions for each transaction.

Considerations

Some over-counting and under-counting of transaction volume may occur:

- Some transactions may be reported as fully electronic transactions even if they were initially sent as a manual transaction and then converted to a fully electronic transaction by a practice management system. No direct relationships between or among the volumes of transactions should be inferred.

- Some eligibility and benefit verification transactions may never result in a claim submission or claim payment since some practice management systems make periodic eligibility and benefit verification requests that are not connected to patient encounters.

- Some claim submission transactions may not be requests for payment since only a few plans can distinguish claim submissions that are requests for payment from encounter reports versus claim submissions that are only transmissions of medical service information, such as for value-based payments and capitation arrangements.

- Some transactions may not result in a claim payment transaction if there is no payment due from the health plan after adjudication, such as when a patient is meeting the annual deductible.

- Due to availability of data and the ability to report data in the required format, health plan and providers may be unable to report values for all modes. Blank cells may not indicate that a mode is not used to complete a transaction but rather that data in not available.

The results of this report are based on surveys and may be subject to response bias.

The CAQH Index uniquely tracks only direct costs:

- Costs reported include the labor time required to conduct the transaction, not the time and cost associated with gathering information for the transaction and follow-up. System costs are

excluded from the cost and savings estimates. - Sample variation may impact some transaction cost trends from year to year.

- Medical and dental provider costs to conduct a transaction reflect only a snapshot in time for the specific group of providers. Sampling factors such as salary increases or declines, learning curve for a new employee to process a transaction and the mix of specialty type may impact the trending of data.

- The ability to report on all transactions exchanged is dependent on accurate reporting practices used by health plans and providers. Due to employment changes and increases in utilization after the pandemic emergency, some health plans and providers may have had new staff gathering and submitting data, increasing data variability.

- The cost calculation methodology calculates each step (salary, time, and unit cost) as separate results on average based on the provider distribution by size and specialty. This is designed to create a modular and replicable process for cost calculation that can be useful to the industry. However, this assumes that the time and unit cost are independent of each other at the provider level. If results were explicitly calculated at the provider group or respondent level, there may be some slight variation in the overall outcome.

Endnotes

Background and Recruitment

1 AIS Health Data, a Division of Managed Markets Insight and Technology, LLC, AIS’s Directory of Health plans: 2025.

2 National Association of Dental Health Plans, Dental Benefits Report, 2023.

3 NORC at the University of Chicago is an independent research institution that delivers insights and data analysis for government, nonprofits, and businesses. For more information, visit: https://www.norc.org/Pages/default.aspx.

Data Collection

4 Interoperability and Prior Authorization Final Rule (CMS-0057-F), Federal Register: Medicare and Medicaid Programs; Patient Protection and Affordable Care Act; Advancing Interoperability and Improving Prior Authorization Processes for Medicare Advantage Organizations, Medicaid Managed Care Plans, State Medicaid Agencies, Children’s Health Insurance Program (CHIP) Agencies and CHIP Managed Care Entities, Issuers of Qualified Health Plans on the Federally-Facilitated Exchanges, Merit-Based Incentive Payment System (MIPS) Eligible Clinicians, and Eligible Hospitals and Critical Access Hospitals in the Medicare Promoting Interoperability Program | Federal Register.

5 Ibid.

Metrics

6 “Physician Practice Benchmark Survey”. AMA (2025). | ama.org.

7 “Physician Specialty Data Report”. AAMC (2024). | aamc.org.

8 “Provider Data” | CAQH.

9 “Distribution of dentists according to size of dental practice and affiliation with a dental support organization (DSO) (XLSX)” ADA. (May 2023). | ada.org.

10 AIS Health Data, a Division of Managed Markets Insight and Technology, LLC, AIS’s Directory of Health plans: 2025.

11 National Association of Dental Health Plans, Dental Benefits Report, 2023.

- IN THIS SECTION

- Introduction

- Background & Recruitment

- Data Collection

- Metrics

- Endnotes

Introduction

As healthcare grappled with workforce shortages in 2023 — a lingering effect of the pandemic — organizations continued to face rising costs to attract and retain essential staff.9,10

This challenge coincided with the end of the COVID-19 Public Health Emergency (PHE),11 as well as heightened cyber threats, increased focus on data security, and demand for Artificial Intelligence (AI) to help streamline workflows. The pandemic had already set a rapid shift in motion toward automated data exchanges between providers and health plans, and in 2023, that shift continued to transform administrative workflows, helping healthcare organizations adapt and find efficiencies amidst ongoing challenges.

In the medical industry, despite rising staffing costs, overall spending on administrative tasks held steady thanks to increased automation, which lowered transaction costs. In contrast, administrative costs in the dental industry rose as task volume and expenses grew. With healthcare utilization on the rise, administrative tasks increased, adding pressure to ongoing staffing challenges.12,13 In response, organizations prioritized operational efficiencies.14 Electronic workflows were adopted to cut down on costly manual tasks for providers and staff.

However, some providers and staff preferred manual processes due to implementation costs and familiarity with current methods.

At the same time, many organizations explored AI and large language models to reduce administrative burden and staff fatigue. Cybersecurity was a priority, with a record 725 major healthcare breaches reported in 2023.15 Organizations invested in technology to counter cyber threats and protect electronic systems from attacks. They focused on safeguarding data, infrastructure, and reducing staff burnout. Automation and AI emerged as key tools to lighten manual workloads, enabling providers and staff to deliver quality care more efficiently.16

Automation helped the industry avoid spending $222 billion on administrative tasks measured in the CAQH Index — a 15 percent increase from the previous year. Reducing manual tasks not only lowered costs and saved time but has the potential to boost staff satisfaction and ultimately patient care.17,18 Organizations should continue promoting and investing in automated workflows through initiatives, trainings, and communications while staying vigilant against cyber threats. As health plans and practices work to maximize resources, technologies like AI are increasingly seen as valuable solutions.19 The industry should continue to examine AI’s impact on administrative tasks, with a focus on boosting efficiency, saving time, and costs. These goals benefit health plans, providers, staff, and, ultimately, patients and their families.

The 2025 Findings Are In

Explore 2025 data and filter for the results that matter to you.

Adoption: What's Leading the Way

Data Insights

See which transactions are the most automated and where there’s opportunity to expand electronic adoption further.

Volume: Where the Action Is

Data Insights

Explore the transactions driving the most activity.

Estimated Spend: The Cost Landscape

Data Insights

See which transactions have the highest and lowest expenses and where improving efficiency could deliver the biggest gains.

Cost Savings: How Automation Pays Off

Data Insights

Discover where automation delivers the biggest returns and where greater efficiency could unlock new value.

Medical Plan Adoption of Fully Electronic Administrative Transactions, 2021-2025

Dental Plan Adoption of Fully Electronic Administrative Transactions, 2021-2025

Medical and Dental Industry Estimated National Volume and Cost Savings Opportunity, 2016-2025 (in billions)

Medical and Dental Industry Estimated National Administrative Spend, 2023-2025 (in billions)

Medical and Dental Industry Estimated National Cost Avoided, 2023-2025 (in billions)

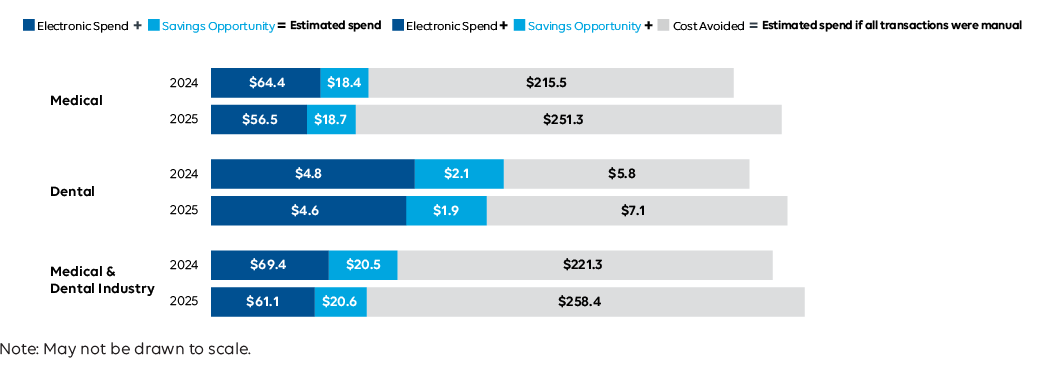

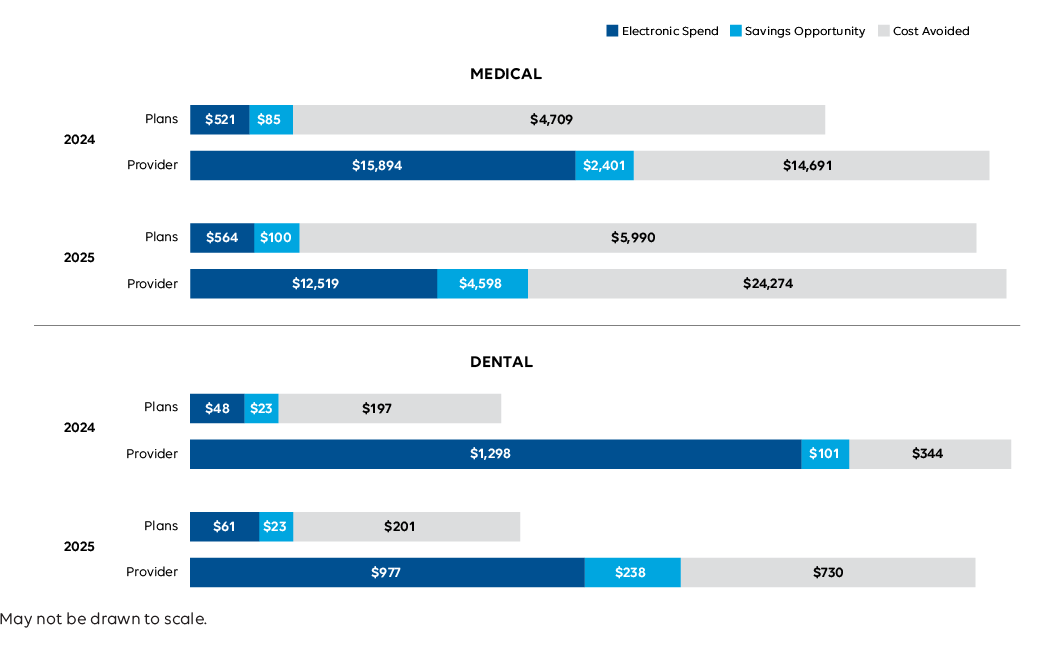

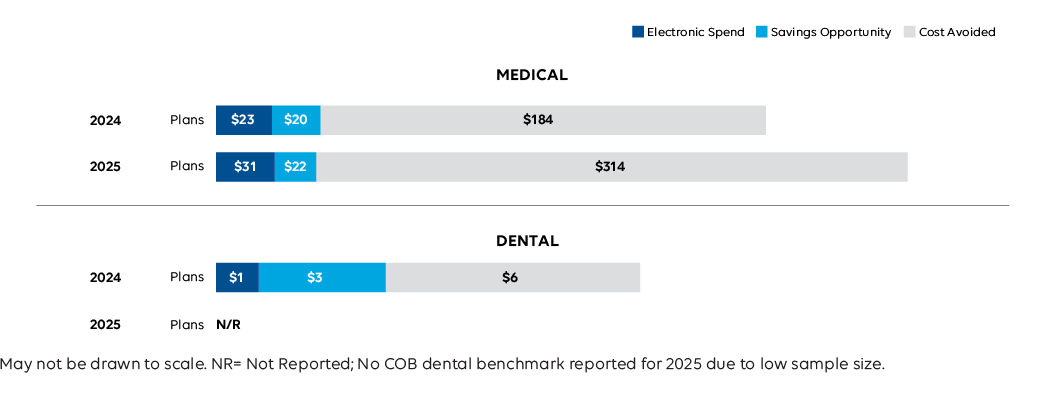

Medical and Dental Industry Estimated National Spend and Savings, 2024-2025 CAQH Index (in billions)

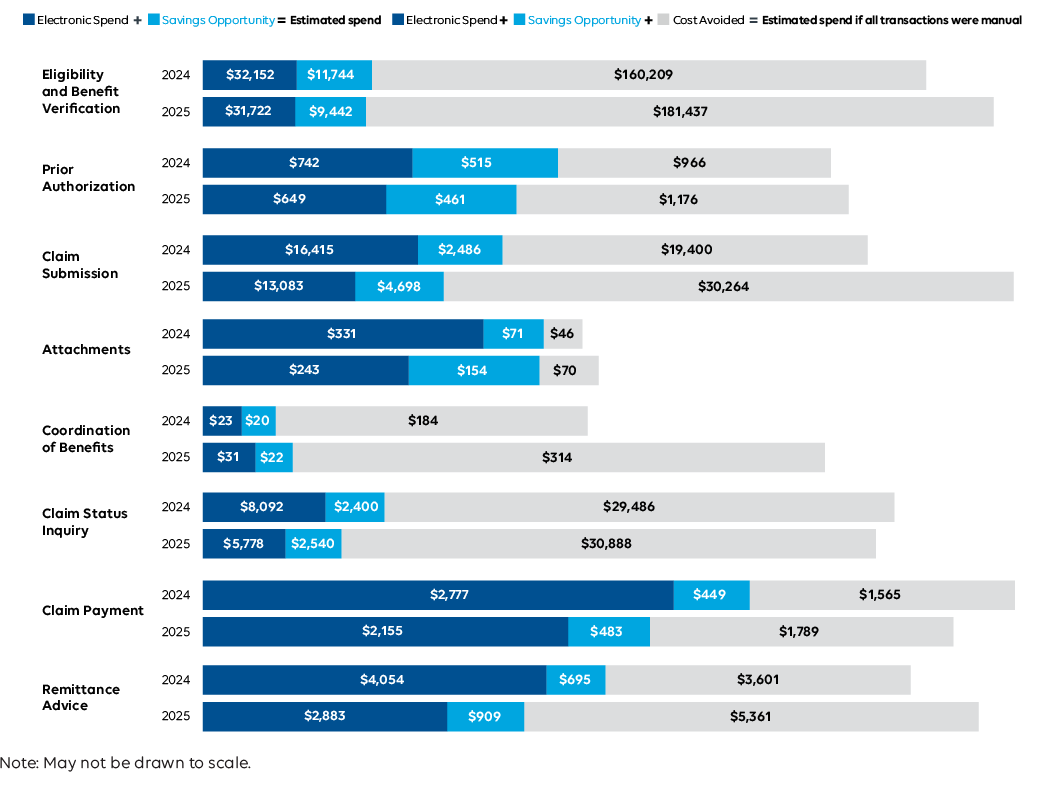

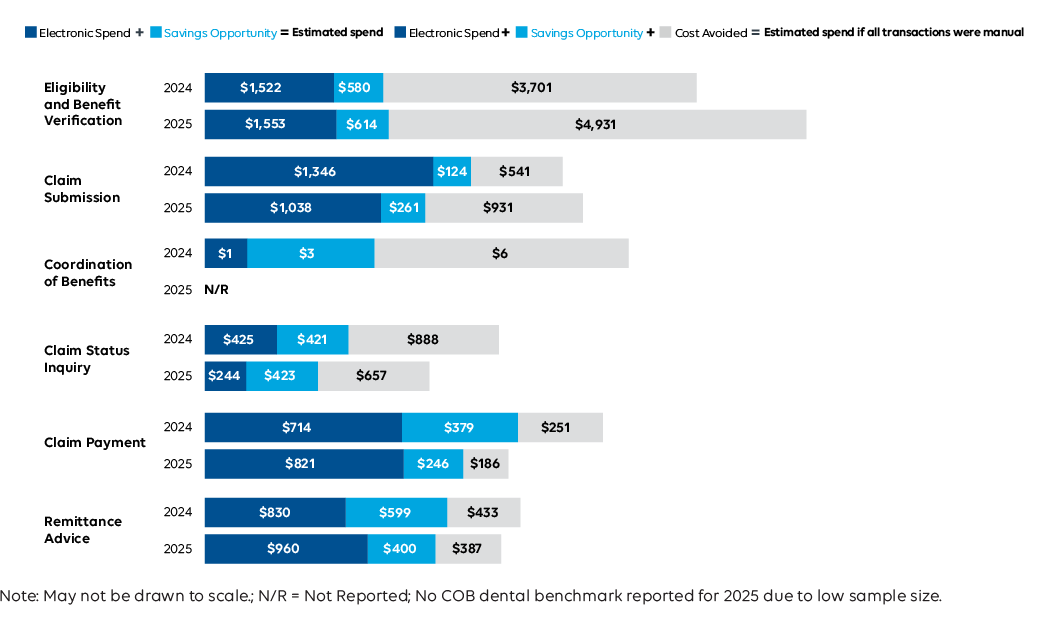

Medical Industry Estimated National Spend and Savings by Transaction, 2024-2025 (in millions)

Dental Industry Estimated National Spend and Savings by Transaction, 2024-2025 (in millions)

Medical and Dental Industry Estimated Cost Savings Opportunity and Year-Over-Year Change, 2024-2025

Medical and Dental Plan Adoption of Eligibility and Benefit Verification, 2023-2025

Industry Impact: Automated eligibility checks help providers confirm coverage and give patients clearer cost information before care is delivered. When these workflows were disrupted by the cyberattack, providers faced more manual work and delays, while patients experienced greater uncertainty at the point of service. Reliable automation remains essential to reducing administrative burden and supporting informed care decisions.

Estimated National Volume of Eligibility and Benefit Verification by Mode, 2023-2025 (in millions)

Data Insights

After decreasing the previous two years, medical partial (portal) volume increased 28%, the largest rise in the Index, reflecting recovery and rerouted transactions after the Change Healthcare outage.¹

Transaction Definition

An inquiry from a provider to a health plan or from one health plan to another to obtain eligibility, coverage, or benefits associated with the plan and a response from the health plan to the provider. Does not include referrals (applicable only to providers). HIPAA Transaction Standard: ASC X12N 270/271.

Industry Impact: Automated eligibility checks help providers confirm coverage and give patients clearer cost information before care is delivered. When these workflows were disrupted by the cyberattack, providers faced more manual work and delays, while patients experienced greater uncertainty at the point of service. Reliable automation remains essential to reducing administrative burden and supporting informed care decisions.

1 The Change Healthcare Cyber Attack: What You Need to Know | PYA.

Eligibility and Benefit Verification: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

The savings opportunity for medical fell 20% as provider manual processes became less expensive. Dental increased 6%, reflecting limited dental-specific data that continues to require phone calls. Industry collaborations are underway to improve dental eligibility workflows.¹Transaction Definition

An inquiry from a provider to a health plan or from one health plan to another to obtain eligibility, coverage, or benefits associated with the plan and a response from the health plan to the provider. Does not include referrals (applicable only to providers). HIPAA Transaction Standard: ASC X12N 270/271.

Industry Impact: Automated eligibility checks help providers confirm coverage and give patients clearer cost information before care is delivered. When these workflows were disrupted by the cyberattack, providers faced more manual work and delays, while patients experienced greater uncertainty at the point of service. Reliable automation remains essential to reducing administrative burden and supporting informed care decisions.

1 Benefit verification drives increased administrative spending in dental offices | ADA.

Medical Plan Adoption of Prior Authorization, 2023-2025

Data Insights

Electronic adoption rose 5 percentage points, the strongest gain of any workflow, reflecting industry momentum to accelerate the prior authorization process and expand automation efforts across health plans.1,2

Transaction Definition

A request from a provider to a health plan to obtain authorization for healthcare services or a response from a health plan for an authorization. Does not include referrals. HIPAA Transaction Standard: ASC X12N 278.

Industry Impact: Electronic prior authorization is helping reduce delays in care, but manual steps still slow providers and frustrate patients. When automation falls short, approvals take longer and administrative costs rise, increasing the risk of postponed treatment. Continued progress is critical to ensuring patients receive timely care while easing the operational burden on providers.

Estimated National Volume of Prior Authorization by Mode, 2023-2025 (in millions)

Industry Impact: Electronic prior authorization is helping reduce delays in care, but manual steps still slow providers and frustrate patients. When automation falls short, approvals take longer and administrative costs rise, increasing the risk of postponed treatment. Continued progress is critical to ensuring patients receive timely care while easing the operational burden on providers.

Prior Authorization: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

The savings opportunity decreased (10%), the first observed decline since 2020, driven by reduced manual volume, greater adoption, and lower electronic costs.¹

Transaction Definition

A request from a provider to a health plan to obtain authorization for healthcare services or a response from a health plan for an authorization. Does not include referrals. HIPAA Transaction Standard: ASC X12N 278.

Industry Impact: Electronic prior authorization is helping reduce delays in care, but manual steps still slow providers and frustrate patients. When automation falls short, approvals take longer and administrative costs rise, increasing the risk of postponed treatment. Continued progress is critical to ensuring patients receive timely care while easing the operational burden on providers.

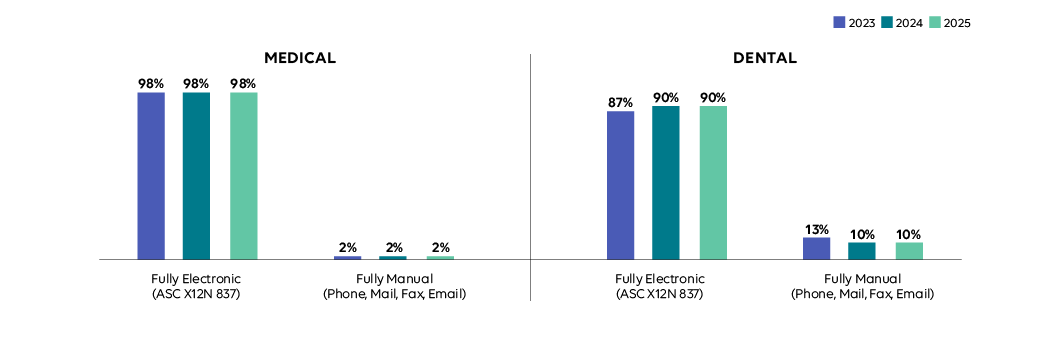

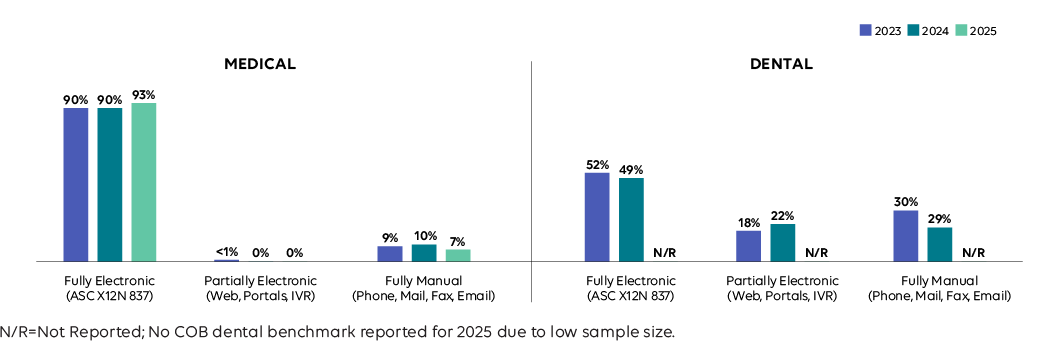

Medical and Dental Plan Adoption of Claim Submission, 2023-2025

Industry Impact: Automated claims support faster, more accurate payments for providers and fewer billing surprises for patients. When automation was disrupted by the cyberattack, manual work increased, slowing payments and raising the risk of errors. These delays strain provider operations and can create confusion or unexpected costs for patients, reinforcing the importance of reliable, resilient claims automation.

Estimated National Volume of Claim Submission by Mode, 2023-2025 (in millions)

Data Insights

Overall volumes grew driven by increases in manual submissions for medical (20%) and dental (12%), reversing last year’s decline in manual volume. Providers reverted to manually submitting claims during system shutdowns.¹

Transaction Definition

A request to obtain payment or transmission of encounter information for the purpose of reporting delivery of healthcare services. HIPAA Transaction Standard: ASC X12N 837.

Industry Impact: Automated claims support faster, more accurate payments for providers and fewer billing surprises for patients. When automation was disrupted by the cyberattack, manual work increased, slowing payments and raising the risk of errors. These delays strain provider operations and can create confusion or unexpected costs for patients, reinforcing the importance of reliable, resilient claims automation.

1 OFR Brief Series: The Cyberattack on Change Healthcare: Lessons for Financial Stability | OFR.

Claim Submission: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

Savings opportunity rose over 85% for medical and dental as providers shifted to manual claims during the Change Healthcare outage. Higher manual costs and lower electronic spend widened cost gaps, increasing potential savings.¹

Transaction Definition

A request to obtain payment or transmission of encounter information for the purpose of reporting delivery of healthcare services. HIPAA Transaction Standard: ASC X12N 837.

Industry Impact: Automated claims support faster, more accurate payments for providers and fewer billing surprises for patients. When automation was disrupted by the cyberattack, manual work increased, slowing payments and raising the risk of errors. These delays strain provider operations and can create confusion or unexpected costs for patients, reinforcing the importance of reliable, resilient claims automation.

1 Change Healthcare cyberattack impact | AMA.

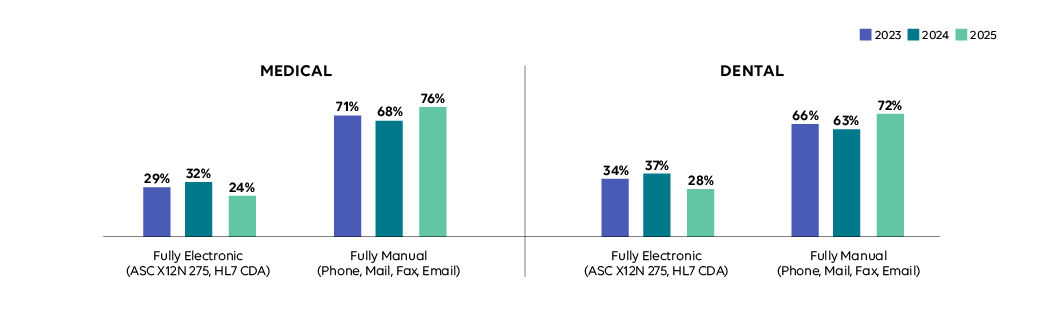

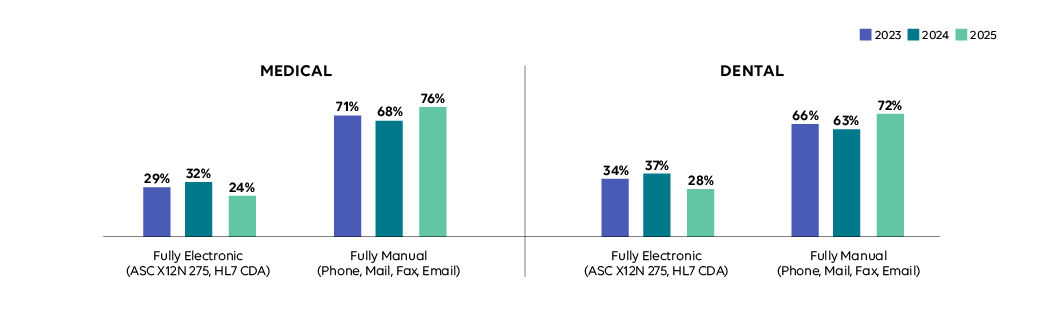

Medical and Dental Plan Adoption of Attachments, 2023-2025

Data Insights

With no federally mandated standard, electronic attachments adoption remains the lowest and declined 8 points in medical and 9 in dental as connectivity issues due to the cyberattack led to more manual exchanges.¹

Transaction Definition

Additional information submitted with claims for payment, claim appeals or prior authorization, such as medical records to support a claim or to explain the need for a procedure or service. Transaction Standards: ASC X12N 275, HL7 CDA.

Industry Impact: Electronic attachments help providers share clinical information quickly, supporting faster approvals and payments. When progress reversed and providers returned to email and fax, coordination slowed and administrative work increased. For patients, these delays can affect care timelines and payment clarity, highlighting the need for standardized, resilient electronic attachment workflows.

1 ADA continues response to Change Healthcare cyberattack | ADA.

Estimated National Volume of Attachments by Mode, 2023-2025 (in millions)

Data Insights

The cyberattack heavily disrupted document exchanges. Manual exchanges rose 15% in medical and 24% in dental, while electronic exchanges fell 24% and 15%, respectively.¹

Transaction Definition

Additional information submitted with claims for payment, claim appeals or prior authorization, such as medical records to support a claim or to explain the need for a procedure or service. Transaction Standards: ASC X12N 275, HL7 CDA.

Industry Impact: Electronic attachments help providers share clinical information quickly, supporting faster approvals and payments. When progress reversed and providers returned to email and fax, coordination slowed and administrative work increased. For patients, these delays can affect care timelines and payment clarity, highlighting the need for standardized, resilient electronic attachment workflows.

1 ADA continues response to Change Healthcare cyberattack | ADA.

Attachments: How Much is Spent and Saved with Full Adoption? (in millions)

Industry Impact: Electronic attachments help providers share clinical information quickly, supporting faster approvals and payments. When progress reversed and providers returned to email and fax, coordination slowed and administrative work increased. For patients, these delays can affect care timelines and payment clarity, highlighting the need for standardized, resilient electronic attachment workflows.

Medical and Dental Plan Adoption of Coordination of Benefits, 2023-2025

Industry Impact: When coordination of benefits breaks down, providers face delayed or denied payments and patients are left sorting out confusing bills. Electronic COB reduces these issues by improving accuracy as coverage changes become more common amid job market volatility. Continued adoption helps protect timely reimbursement for providers and a more predictable, less stressful billing experience for patients.

Estimated National Volume of Coordination of Benefits by Mode, 2023-2025 (in millions)

Data Insights

Overall volume grew 29%, the largest gain, driven by a 33% increase in electronic COBs amid a push towards auto-adjudication to determine a payer’s responsibility and broader workforce mobility and market instability in 2024.1,2,3,4

Transaction Definition

Claims that are sent to secondary payers with explanation of payment information from the primary payer to determine remaining payment responsibilities. HIPAA Transaction Standard: ASC X12N 837.

Industry Impact: When coordination of benefits breaks down, providers face delayed or denied payments and patients are left sorting out confusing bills. Electronic COB reduces these issues by improving accuracy as coverage changes become more common amid job market volatility. Continued adoption helps protect timely reimbursement for providers and a more predictable, less stressful billing experience for patients.

1 Economic News Release – Current Employment Statistics Preliminary Benchmark (National) Summary | BLS.

2 The U.S. labor market added 911,000 fewer jobs than earlier reported, BLS says | CBS News.

3 United States: Challenger Report | Moody’s Analytics.

4 How Improving Auto-Adjudication Rates Can Enhance Health Plan Performance | HealthEdge.

Coordination of Benefits: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

Overall spend increased 23%, the largest growth, reflecting increased manual costs and the need for greater coordination activity among health plans. 1

Transaction Definition

Claims that are sent to secondary payers with explanation of payment information from the primary payer to determine remaining payment responsibilities. HIPAA Transaction Standard: ASC X12N 837.

Industry Impact: When coordination of benefits breaks down, providers face delayed or denied payments and patients are left sorting out confusing bills. Electronic COB reduces these issues by improving accuracy as coverage changes become more common amid job market volatility. Continued adoption helps protect timely reimbursement for providers and a more predictable, less stressful billing experience for patients.

1 Economic News Release – Current Employment Statistics Preliminary Benchmark (National) Summary | BLS.

Medical and Dental Plan Adoption of Claim Status Inquiry, 2023-2025

Data Insights

Electronic dental adoption fell 5 percentage points as providers relied more on portals to check the status of claims when electronic systems were disrupted during the cyberattack.1

Transaction Definition

An inquiry from a provider to a health plan to determine the status of a healthcare claim or a response from the health plan. HIPAA Transaction Standard: ASC X12N 276/277.

Industry Impact: Reliable electronic claim status tools help providers track payments without costly follow-up and give patients clearer expectations about when bills will be resolved. Greater use of electronic and hybrid processes helped limit administrative cost increases and reduce uncertainty, reinforcing automation's role in keeping payments moving and patient questions manageable.

1 Change Healthcare’s cyberattack impacting dental practices | ADA.

Estimated National Volume of Claim Status Inquiry by Mode, 2023-2025 (in millions)

Industry Impact: Reliable electronic claim status tools help providers track payments without costly follow-up and give patients clearer expectations about when bills will be resolved. Greater use of electronic and hybrid processes helped limit administrative cost increases and reduce uncertainty, reinforcing automation's role in keeping payments moving and patient questions manageable.

Claim Status Inquiry: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

Spending fell 21% in both industries, the largest declines reported. Even with lower dental plan adoption, providers saw reduced costs and shorter times for manual and electronic inquiries, reflecting improved efficiency and cost control.Transaction Definition

An inquiry from a provider to a health plan to determine the status of a healthcare claim or a response from the health plan. HIPAA Transaction Standard: ASC X12N 276/277.

Industry Impact: Reliable electronic claim status tools help providers track payments without costly follow-up and give patients clearer expectations about when bills will be resolved. Greater use of electronic and hybrid processes helped limit administrative cost increases and reduce uncertainty, reinforcing automation's role in keeping payments moving and patient questions manageable.

Medical and Dental Plan Adoption of Claim Payment 2023-2025

Data Insights

Electronic dental adoption rose 3 percentage points, the only dental transaction to increase, driven by expanded EFT education and promotion.1

Transaction Definition

An electronic funds transfer (EFT) from a health plan’s bank to a provider’s bank; including payment and data specific to the payment. HIPAA Transaction Standard: NACHA Corporate Credit or Deposit Entry with Addenda Record (CCD+).

Industry Impact: Electronic payments help providers receive reimbursements quickly and keep operations running, which supports more consistent billing for patients. During the cyberattack, alternative payment approaches, such as bundled payments, helped prevent widespread payment delays. This underscores the importance of stable, resilient payment processes to protect provider viability and reduce billing disruption for patients.

1 How electronic funds transfer can benefit your dental practice | ADA.

Estimated National Volume of Claim Payment by Mode, 2023-2025 (in millions)

Industry Impact: Electronic payments help providers receive reimbursements quickly and keep operations running, which supports more consistent billing for patients. During the cyberattack, alternative payment approaches, such as bundled payments, helped prevent widespread payment delays. This underscores the importance of stable, resilient payment processes to protect provider viability and reduce billing disruption for patients.

Claim Payment: How Much is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

Medical spending fell 18% as volume and provider times declined. Bundled or accelerated payments were used to manage backlogs caused by electronic system outages.1 Dental savings opportunity fell 35%, as manual cost and volume dropped, indicating progress for the industry.

Transaction Definition

An electronic funds transfer (EFT) from a health plan’s bank to a provider’s bank; including payment and data specific to the payment. HIPAA Transaction Standard: NACHA Corporate Credit or Deposit Entry with Addenda Record (CCD+).

Industry Impact: Electronic payments help providers receive reimbursements quickly and keep operations running, which supports more consistent billing for patients. During the cyberattack, alternative payment approaches, such as bundled payments, helped prevent widespread payment delays. This underscores the importance of stable, resilient payment processes to protect provider viability and reduce billing disruption for patients.

1 CMS Change Healthcare/Optum Payment Disruption (CHOPD) Accelerated Payments to Part A Providers | CMS.

Medical and Dental Plan Adoption of Remittance Advice, 2023-2025

Data Insights

Medical adoption decreased 2 percentage points as the exchange of electronic remittance advices was limited during the cyberattack.1

Transaction Definition

The transmission of explanation of benefits or remittance advice from a health plan to a provider explaining a payment. HIPAA Transaction Standard: ASC X12N 835.

Industry Impact: A remittance advice explains how claims were paid and helps providers reconcile payments. Electronic remittance advices enhance accuracy and communication across the healthcare system, enabling plans to operate more efficiently, providers to receive accurate, timely payments, and patients to better understand their healthcare costs. When this workflow was disrupted, providers and plans had to rely on more manual reconciliations, adding work and slowing resolution times, which underscores the need for reliable, stable systems.

1 Change Healthcare cyberattack impact | AMA.

Estimated National Volume of Remittance Advice by Mode, 2023-2025 (in millions)

Data Insights

Overall medical volume fell 6%, the largest decline, driven by a 10% drop in electronic volume. Manual volume rose 18% after 4 years of decline, as payment reconciliation and deferred processing moved offline as the industry addressed system disruptions. 1

Transaction Definition

The transmission of explanation of benefits or remittance advice from a health plan to a provider explaining a payment. HIPAA Transaction Standard: ASC X12N 835.

Industry Impact: A remittance advice explains how claims were paid and helps providers reconcile payments. Electronic remittance advices enhance accuracy and communication across the healthcare system, enabling plans to operate more efficiently, providers to receive accurate, timely payments, and patients to better understand their healthcare costs. When this workflow was disrupted, providers and plans had to rely on more manual reconciliations, adding work and slowing resolution times, which underscores the need for reliable, stable systems.

1 Revenue Cycle Leaders Share Impact, Insights from Change Healthcare Cyberattack | Journal of AHIMA.

Remittance Advice: How much Is Spent and Saved with Full Adoption?, 2024-2025 (in millions)

Data Insights

After dropping 1% the previous year, the medical savings opportunity increased 31% as manual volume, costs and provider time to conduct increased, and electronic costs and volume decreased. Conversely, for dental it decreased 33% as provider manual and portal costs decreased.Transaction Definition

The transmission of explanation of benefits or remittance advice from a health plan to a provider explaining a payment. HIPAA Transaction Standard: ASC X12N 835.

Industry Impact: A remittance advice explains how claims were paid and helps providers reconcile payments. Electronic remittance advices enhance accuracy and communication across the healthcare system, enabling plans to operate more efficiently, providers to receive accurate, timely payments, and patients to better understand their healthcare costs. When this workflow was disrupted, providers and plans had to rely on more manual reconciliations, adding work and slowing resolution times, which underscores the need for reliable, stable systems.

Average Cost and Savings Opportunity per Transaction by Mode, Medical, 2025

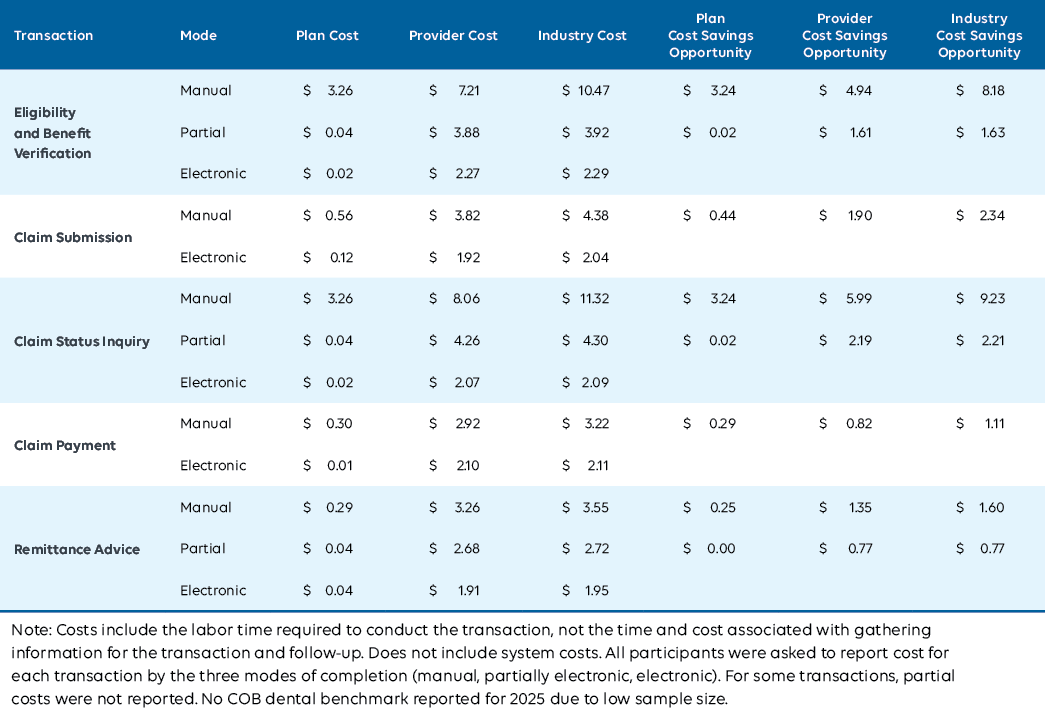

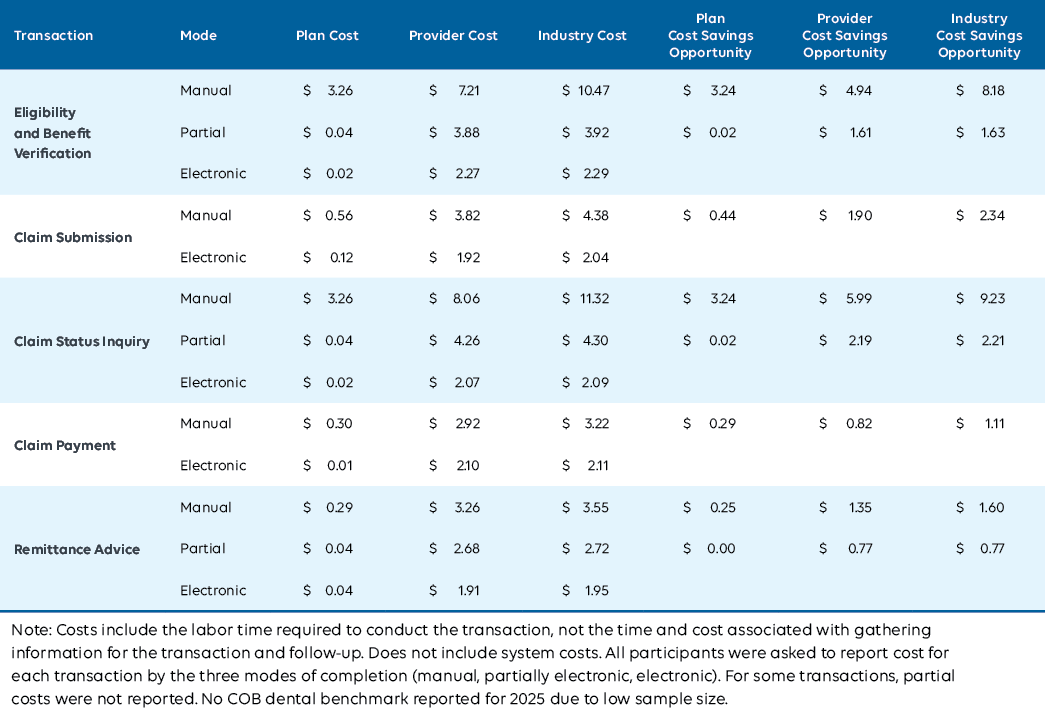

Average Cost and Savings Opportunity per Transaction by Mode, Dental, 2025

Estimated National Volume and Cost Savings Opportunity by Mode, Medical, 2025

Estimated National Volume and Cost Savings Opportunity by Mode, Dental, 2025

Annual Volume Reported by Medical and Dental Plans, 2024-2025

Estimated Medical and Dental Spend, Cost Savings Opportunity and Cost Avoided, 2025 (in millions)

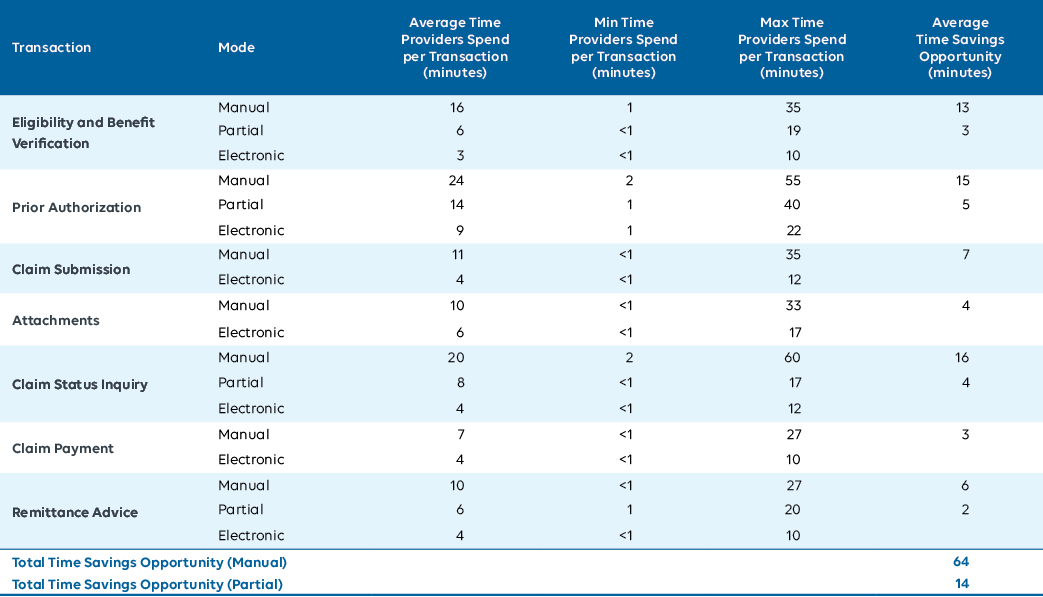

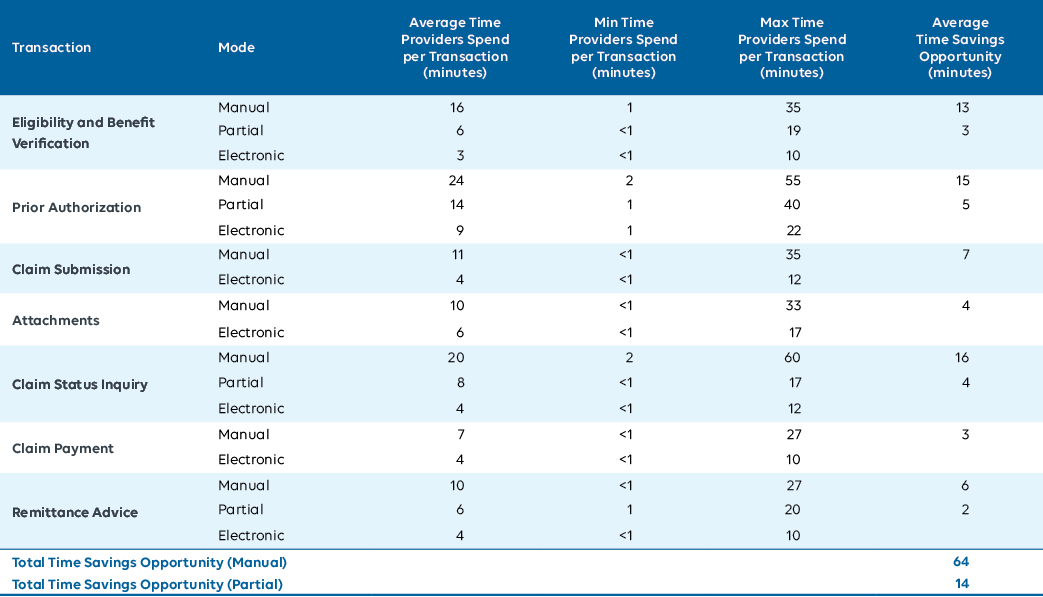

Average, Minimum and Maximum Provider Time Spent Conducting Transactions, Medical, 2025

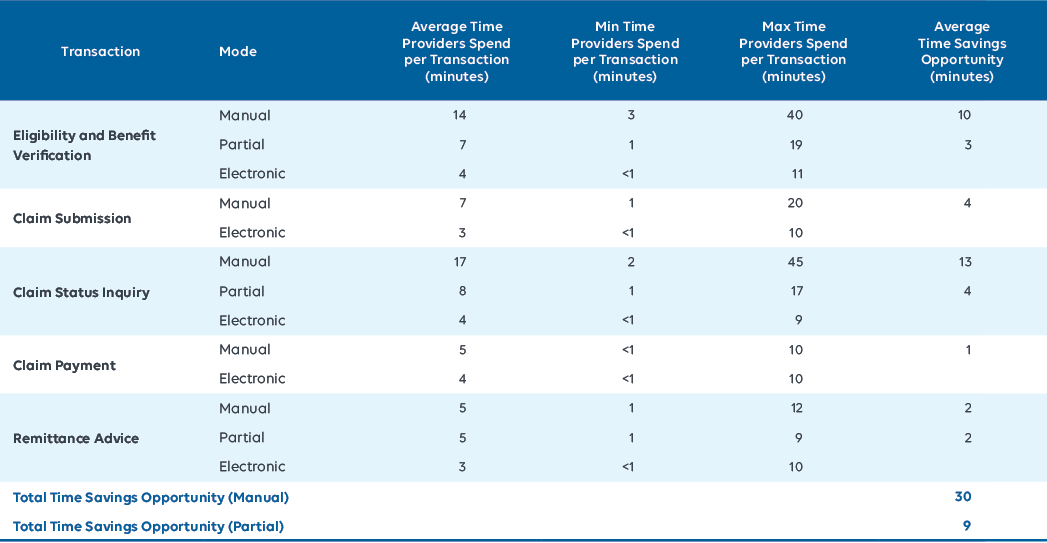

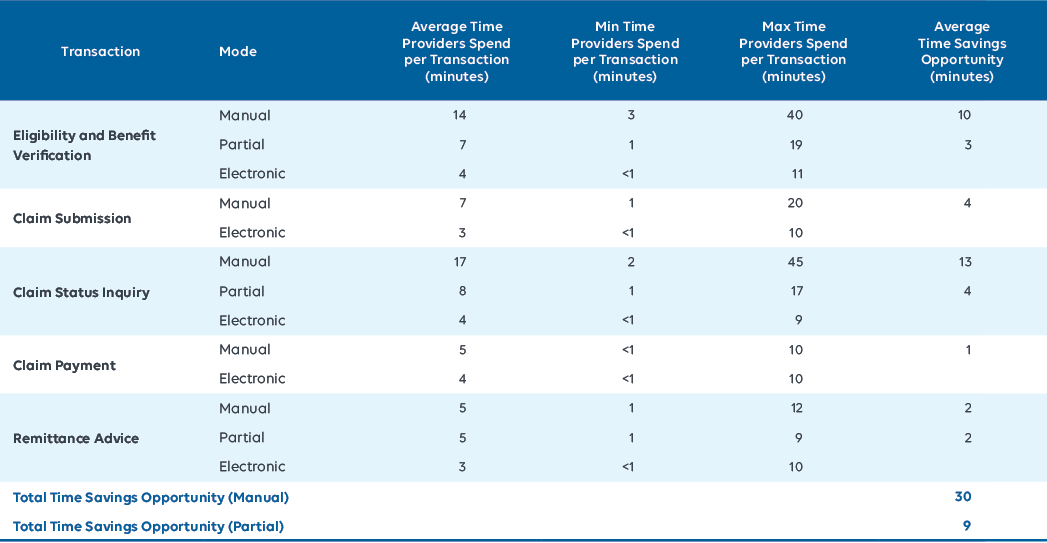

Average, Minimum and Maximum Provider Time Spent Conducting Transactions, Dental, 2025

- CHARTBOOK

- Introduction

- View Data